Louisiana small business health insurance can be a real headache, but it doesn’t have to be! Navigating the options and regulations can feel overwhelming, but this guide breaks down everything you need to know to find the perfect plan for your business. We’ll cover everything from costs and compliance to employee benefits and resources.

Understanding the nuances of Louisiana’s small business health insurance market is crucial for ensuring your business and employees are properly covered. This guide delves into the key aspects of this important topic, providing practical insights and actionable advice. Get ready to make informed decisions!

Overview of Louisiana Small Business Health Insurance

Small businesses in Louisiana face unique challenges when it comes to providing health insurance to their employees. Navigating the complex landscape of regulations, plan types, and misconceptions can be daunting. This overview clarifies the current situation, highlighting key regulations and available options to help Louisiana small businesses make informed decisions.

Louisiana’s Regulatory Framework

Louisiana’s regulatory environment for small business health insurance is shaped by federal and state laws. The Affordable Care Act (ACA) mandates certain requirements for all employers, regardless of size. In Louisiana, these federal mandates are interwoven with state-specific regulations, which can sometimes create additional requirements or interpretations. This combined regulatory framework aims to ensure access to affordable health insurance, but it can present challenges for small businesses in complying with all provisions.

Key Regulations and Requirements

Several key regulations affect small businesses offering health insurance in Louisiana. These include mandates related to minimum essential coverage, the employer’s responsibility for employee contributions, and the availability of premium tax credits. Understanding these regulations is critical for businesses to avoid penalties and ensure compliance. Furthermore, Louisiana’s rules concerning pre-existing conditions and essential health benefits should be meticulously considered.

Common Misconceptions

Several misconceptions surround small business health insurance in Louisiana. One common misconception is that small businesses are exempt from ACA requirements. This is incorrect; all employers, regardless of size, must comply with certain ACA provisions. Another misconception is that the cost of health insurance is uniformly high for all businesses. In reality, factors such as employee demographics, location, and chosen plan type influence the premiums.

Misunderstanding these factors can lead to inaccurate estimations of costs.

Types of Health Insurance Plans

A variety of health insurance plans are available to small businesses in Louisiana. These plans generally fall into categories like Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and high-deductible health plans with health savings accounts (HDHPs). Each plan type has distinct features, such as network coverage and cost-sharing arrangements, influencing the suitability for specific business needs. Small businesses must carefully evaluate these differences to select a plan that aligns with their employees’ needs and the budget.

Cost and Affordability Factors

Small business owners in Louisiana face a critical challenge in providing health insurance to their employees. Understanding the costs, available plans, and financial assistance programs is essential for making informed decisions. The affordability of health insurance directly impacts the ability of businesses to thrive and retain employees.The cost of small business health insurance in Louisiana varies significantly depending on several factors.

Premiums, deductibles, and overall affordability depend on the specific plan chosen and the characteristics of the workforce. Recognizing these factors is crucial for businesses to effectively budget for employee benefits.

Average Costs of Small Business Health Insurance in Louisiana

The average cost of small business health insurance in Louisiana is influenced by factors such as the size of the workforce, employee demographics, and chosen plan type. Comprehensive data on specific averages isn’t readily available publicly, but anecdotal evidence suggests costs are influenced by local market conditions.

Comparison of Premiums and Deductibles Across Different Plan Types

Different health insurance plans in Louisiana offer varying premium and deductible structures. High-deductible health plans (HDHPs) typically have lower premiums but higher deductibles. These plans often include health savings accounts (HSAs) to help offset costs. Conversely, plans with lower deductibles often come with higher premiums. Understanding the trade-offs between premium and deductible amounts is crucial for small business owners.

Factors Influencing the Cost of Health Insurance for Small Businesses

Several factors contribute to the cost of health insurance for small businesses in Louisiana. Employee demographics, such as age, health status, and family size, can significantly affect premiums. Businesses in industries with higher healthcare utilization, like healthcare itself or manufacturing, may face higher costs. The specific plan chosen, including coverage levels and network options, also influences the final price.

Yo, Louisiana small businesses are, like, totally struggling with health insurance costs, right? It’s a total nightmare, tbh. But, if you’re into that whole One Night at a Time tour merch thing, check out the latest drops here. Seriously, though, finding affordable health insurance for your small biz is a total grind. It’s a real pain in the neck, for sure.

Financial Assistance Programs for Small Businesses

Several programs aim to ease the burden of health insurance costs for small businesses in Louisiana. The Louisiana Small Business Health Insurance Assistance Program (if one exists) might offer subsidies or other forms of financial assistance. Additionally, federal programs like the Small Business Administration (SBA) may have grants or loans designed to support small businesses. Exploring these resources is important for reducing the financial burden of employee benefits.

Examples of Financial Assistance Programs

The Louisiana Small Business Development Center (LSBDC) can provide guidance on various financial assistance options, including potential grants or low-interest loans for health insurance. Furthermore, the Louisiana Office of Insurance may have programs to help businesses understand their options.

Table Illustrating Varying Costs of Health Insurance Plans Based on Company Size

Unfortunately, precise cost data is not readily available in a structured table format for this discussion. General trends suggest that smaller businesses often face higher costs per employee due to lower bargaining power and smaller group sizes. Larger companies can often negotiate lower premiums, leading to potentially lower costs per employee.

Access and Availability

Small business owners in Louisiana face a diverse landscape when seeking health insurance. Availability and access vary significantly depending on factors like business size, industry, and location within the state. Navigating the options can be challenging, requiring careful consideration of coverage specifics and provider expertise.

Availability of Plans Across Industries

The availability of small business health insurance plans in Louisiana is influenced by the specific industry. Certain industries, like healthcare or construction, may have more limited choices or higher premiums due to the nature of the work and potential risks involved. Conversely, industries with a lower risk profile may experience greater plan availability and potentially lower premiums. Small businesses in sectors with a significant workforce may find a broader selection of plans to suit their needs.

Insurance Providers Catering to Small Businesses

Several insurance providers specialize in catering to the needs of small businesses in Louisiana. These providers often understand the unique challenges and complexities of small business health insurance. They offer customized solutions and may have more tailored plans to accommodate varying employee needs. This focus on small businesses ensures a better understanding of their particular requirements and potential risk factors.

Comparison of Health Insurance Providers

| Insurance Provider | Specialties | Coverage Options for Small Businesses |

|---|---|---|

| Blue Cross Blue Shield of Louisiana | Comprehensive coverage options, tailored solutions for various industries, and robust network of providers | Various plans with varying deductibles, co-pays, and out-of-pocket maximums. Options for high-deductible health plans (HDHPs) and health savings accounts (HSAs) may also be available. |

| Louisiana Health Services | Focus on community health, affordability, and accessibility. Plans often include preventative care services and wellness programs. | Plans generally designed with affordability in mind, offering various options based on employee needs and budget constraints. Some plans may prioritize preventative care and wellness programs. |

| UnitedHealthcare | Nationally recognized provider with extensive network of providers, offering plans with varying options for coverage and features. | Extensive network access and customizable options for deductibles, co-pays, and out-of-pocket maximums. Options for high-deductible health plans (HDHPs) and health savings accounts (HSAs) may also be available. |

| Cigna | Strong focus on preventative care, cost-effective options, and personalized service. | Wide range of plans, including options that emphasize preventative care and wellness programs. Customized plans can be tailored to meet the specific needs of each business. |

This table provides a glimpse into the variety of providers and their respective specialties, but it’s not exhaustive. Further research is encouraged to discover additional providers and their unique offerings.

Comparing and Selecting Health Insurance Plans

The process of comparing and selecting health insurance plans in Louisiana requires careful consideration of factors like premiums, deductibles, co-pays, and coverage options. Small businesses should evaluate their specific needs and budget to determine the most suitable plan. A thorough understanding of the plan’s features and the provider’s network is essential.

Finding Reputable Brokers and Agents

Locating reputable brokers and agents who can assist small businesses in Louisiana with the selection process is crucial. These professionals have expertise in navigating the complexities of health insurance and can help small businesses find the most suitable plan. Small businesses can leverage online resources and referrals to identify brokers and agents with a proven track record. Furthermore, seeking recommendations from other small business owners can provide valuable insights.

Compliance and Legal Considerations: Louisiana Small Business Health Insurance

Navigating the legal and regulatory landscape surrounding small business health insurance in Louisiana is crucial for ensuring compliance and avoiding potential penalties. Understanding the specific requirements, especially those related to the Affordable Care Act (ACA), is vital for successful implementation and operation. This section details the legal framework, ACA implications, and comparative analysis with other states, highlighting potential penalties for non-compliance.The Louisiana Department of Insurance and the federal Affordable Care Act (ACA) establish the legal framework for small business health insurance.

This framework Artikels requirements for coverage, eligibility, and reporting, and compliance is essential for businesses to avoid legal issues and maintain good standing.

Legal and Regulatory Framework

Louisiana’s regulatory framework for small business health insurance is rooted in state and federal laws. The state insurance department plays a critical role in enforcing these regulations and ensuring that insurers operate within the defined parameters. Specific regulations may cover aspects like premium rates, coverage levels, and the types of plans offered. The specific rules and regulations are detailed in the Louisiana Insurance Department’s publications and guidelines.

These regulations ensure a level of protection for both small businesses and their employees.

Affordable Care Act (ACA) Implications

The ACA significantly impacts small businesses in Louisiana, particularly those with fewer than 50 employees. These businesses are generally exempt from the ACA’s individual mandate, but they must comply with other provisions, such as the essential health benefits requirement. The ACA’s impact extends to the availability of health insurance exchanges, which can offer affordable options for small businesses.

Furthermore, the ACA often dictates the minimum requirements for health plans, including the inclusion of essential health benefits. The specific rules and their application to small businesses are regularly updated and reviewed by both federal and state agencies.

Comparison of ACA Requirements

Comparing ACA requirements for small businesses in Louisiana with those in other states reveals variations in specifics, though the fundamental principles remain consistent. For example, some states might have additional state-level requirements beyond the federal mandates. Differences could be seen in the specific essential health benefits or the level of premium subsidies offered through state-based health insurance exchanges.

These differences can influence the cost and availability of health insurance for small businesses. Understanding these variations is crucial for businesses operating across state lines or considering expansion.

Potential Penalties for Non-Compliance, Louisiana small business health insurance

Non-compliance with Louisiana health insurance regulations for small businesses can lead to significant penalties. These penalties may include fines, legal action, or even the revocation of insurance licenses. In addition, failure to meet the ACA requirements can result in penalties from the federal government. The specific penalties vary depending on the nature and severity of the violation.

It is crucial for businesses to stay informed about the latest updates to regulations to avoid such penalties.

Summary of Key Compliance Requirements

| Requirement | Description |

|---|---|

| Compliance with Essential Health Benefits (EHBs) | Small businesses must offer health plans that include essential health benefits, as defined by the ACA. |

| Minimum Value of Coverage | Health plans must meet minimum value standards, ensuring adequate coverage for eligible employees. |

| Premium Transparency | Insurers must clearly communicate premium costs and coverage details to small businesses. |

| Reporting Requirements | Small businesses must adhere to reporting requirements for health insurance coverage and participation. |

| Nondiscrimination | Health plans cannot discriminate based on pre-existing conditions or other factors. |

Employee Benefits and Considerations

Attracting and retaining top talent in Louisiana’s competitive job market often hinges on comprehensive employee benefits packages. Small businesses, particularly, must carefully consider the advantages and challenges of offering health insurance, as it directly impacts employee morale, productivity, and overall business sustainability. This section delves into the critical factors surrounding employee benefits, focusing on the significance of health insurance for small businesses in Louisiana.Offering health insurance in Louisiana is a strategic move for small businesses, not just a perk.

It fosters a healthier, more engaged workforce, which in turn contributes to a more productive and stable business environment. Understanding the nuances of different plan structures and employee participation is key to maximizing the return on investment and achieving the desired outcomes.

Importance of Employee Health Benefits

Employee health benefits are vital for small businesses in Louisiana. They are more than just an added expense; they represent a significant investment in employee well-being and, ultimately, business success. Providing health insurance demonstrates a commitment to employee health and financial security, which can translate into increased job satisfaction and reduced employee turnover. This, in turn, lowers recruitment costs and enhances overall operational efficiency.

Benefits of Offering Health Insurance

Providing health insurance offers several tangible benefits to small businesses in Louisiana. These include: improved employee morale, reduced absenteeism, enhanced productivity, and a stronger company reputation. A healthy workforce is a productive workforce. Health insurance helps employees feel valued and supported, leading to higher levels of engagement and loyalty. This translates into reduced employee turnover, which saves the company significant time and resources in recruitment and training.

Positive Impact on Employee Morale and Retention

Offering health insurance directly impacts employee morale and retention. Employees who feel valued and supported by their employer are more likely to be satisfied with their jobs and committed to their work. When employees have access to affordable health insurance, they experience a sense of security and reduce financial stress, which can positively influence their work performance. Examples of positive impacts include reduced stress-related sick days and increased job satisfaction, both impacting the bottom line.

Employees are more likely to stay with a company that prioritizes their well-being.

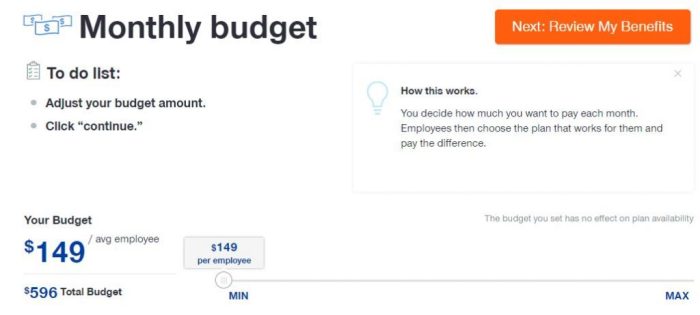

Structuring Employee Health Insurance Plans

Small businesses in Louisiana have several approaches to structuring employee health insurance plans. These include: self-funding, purchasing group plans through an insurance provider, or using a combination of both. Each method has its own set of advantages and disadvantages in terms of cost, administrative burden, and flexibility. Understanding the various approaches is crucial for making informed decisions.

Employee Participation in Decision-Making

Involving employees in the decision-making process for health insurance choices is crucial for a successful program. This fosters a sense of ownership and encourages participation. This approach can include surveys, focus groups, or open forums to gather employee input on preferred plan options and cost considerations. Active employee engagement in the process results in a greater understanding of the needs and preferences of the workforce.

This leads to a more tailored and effective solution that meets the specific needs of the employees and the business.

Yo, tryna sort out Louisiana small biz health insurance, right? It’s a total pain, tbh. But, like, imagine this: you’ve nailed down the perfect health insurance plan, and then you’re craving that sweet, tropical taste of a pina colada cheesecake. Check out this sick recipe for a delicious pina colada cheesecake here. Still, finding the right insurance deal for your Louisiana small business is key.

It’s all about balance, fam.

Resources and Support

Navigating the complexities of small business health insurance can be daunting. Fortunately, numerous resources are available to assist Louisiana small businesses in securing and understanding these crucial benefits. These resources offer valuable guidance and support throughout the entire process, from initial research to ongoing plan management.

Available Resources for Louisiana Small Businesses

Louisiana small businesses have access to a range of resources designed to streamline the health insurance process. These resources span various government agencies, non-profit organizations, and online platforms, providing comprehensive support tailored to the specific needs of small enterprises.

- Louisiana Department of Insurance: This state agency provides crucial information on insurance regulations, licensing, and complaint procedures. It also offers resources on navigating the health insurance marketplace, assisting businesses in understanding their rights and responsibilities.

- Small Business Administration (SBA): The SBA provides various resources and programs designed to help small businesses, including guidance on accessing financial assistance and support for various operational needs, including insurance. They often have workshops and seminars on insurance topics.

- Louisiana Small Business Development Centers (SBDCs): These centers offer one-on-one counseling and workshops to small business owners. They can provide tailored advice on health insurance options and assist in comparing plans and understanding their implications.

- Non-profit Organizations: Several non-profit organizations focus on supporting small businesses and entrepreneurs. These groups frequently offer workshops, seminars, and online resources on health insurance, aiming to empower business owners with the knowledge and tools needed to make informed decisions.

Online Tools and Platforms

Online platforms have become invaluable tools for small businesses seeking health insurance. These platforms offer simplified comparisons, estimates, and educational resources to help businesses navigate the complex landscape of health insurance options.

- HealthCare.gov: While primarily focused on individual health insurance, this federal website offers valuable resources and tools, including plan comparisons and eligibility assessments. Some information can be adapted to the needs of small businesses.

- Independent Insurance Comparison Websites: These websites provide detailed comparisons of health insurance plans based on various criteria. Small businesses can use these tools to compare premiums, coverage options, and provider networks.

Flowchart for Obtaining Small Business Health Insurance in Louisiana

A streamlined process can greatly aid in navigating the health insurance acquisition process. This flowchart demonstrates a typical path for securing small business health insurance in Louisiana.  (A visual flowchart illustrating the steps involved in securing small business health insurance in Louisiana, from initial research to plan selection and enrollment, would be placed here. The flowchart should depict steps like research, consultation, comparing plans, selecting a plan, enrollment, and ongoing management. Specific details about each step, like contacting insurance providers, reviewing policies, and finalizing enrollment, should be shown in each step.)

(A visual flowchart illustrating the steps involved in securing small business health insurance in Louisiana, from initial research to plan selection and enrollment, would be placed here. The flowchart should depict steps like research, consultation, comparing plans, selecting a plan, enrollment, and ongoing management. Specific details about each step, like contacting insurance providers, reviewing policies, and finalizing enrollment, should be shown in each step.)

Tips for Choosing the Right Plan

Careful consideration is vital when selecting a health insurance plan. This selection directly impacts the financial well-being of both the business and its employees.

“Consider factors like premiums, deductibles, co-pays, and out-of-pocket maximums. Also, carefully evaluate the provider network to ensure accessibility to necessary medical professionals.”

Final Summary

In conclusion, Louisiana small business health insurance is a complex but manageable task. By understanding the options, costs, and regulations, you can find a plan that fits your needs and budget. Remember to utilize the resources available and consider the impact on your employees. Armed with this knowledge, you’re well-positioned to make smart decisions and ensure your business thrives.

FAQ Compilation

What are the common misconceptions about Louisiana small business health insurance options?

Many small business owners believe that affordable plans aren’t available or that the process is overly complicated. In reality, various options exist, and resources are available to simplify the process. Don’t let misinformation deter you from exploring the possibilities.

What are some financial assistance programs available to help offset the cost of health insurance for Louisiana small businesses?

Several state and federal programs offer financial assistance to small businesses. These can include tax credits and subsidies designed to reduce the cost of health insurance premiums. Researching these options can significantly lower the burden on your business.

How do employee demographics and industry affect the cost of health insurance for small businesses in Louisiana?

Factors like age, location, and industry of your employees can impact premium costs. Older employees and those in higher-risk industries often have higher premiums. Understanding these factors is key to budgeting for health insurance.

What are the legal and regulatory frameworks for small business health insurance in Louisiana?

Louisiana follows federal regulations, including the Affordable Care Act (ACA). These laws Artikel requirements and compliance procedures. Staying informed about these guidelines is crucial for avoiding penalties.