Crash network insurer report card provides a critical evaluation of insurers’ performance in handling network-related claims. This report card meticulously examines safety scores, financial stability, customer service, and claims data, ultimately offering a transparent view of the crash network insurance sector.

The report card delves into the methodologies employed for assessing these crucial factors, providing a clear understanding of the evaluation process. It examines key performance indicators (KPIs), analyses claims data to identify trends and potential issues, and incorporates customer feedback to gain a holistic view of insurer performance. The ultimate goal is to help consumers make informed decisions and drive improvements in the crash network insurance market.

Introduction to Crash Network Insurer Report Card

A Crash Network Insurer Report Card is a critical assessment tool designed to evaluate the performance of insurance providers specializing in handling claims arising from car accidents. This report card goes beyond simple financial statements to delve into the crucial aspects of safety, financial stability, and customer service within the context of crash network operations. It aims to provide a transparent and impartial view of each insurer’s capabilities, allowing consumers and stakeholders to make informed decisions.This report card is vital for fostering a safer and more efficient crash network.

It helps consumers understand which insurers are best equipped to handle the complexities of a car accident claim, from the initial contact to the final settlement. This, in turn, promotes confidence and empowers consumers with the knowledge to choose the right insurer for their needs. The report card is intended to be a valuable resource for anyone involved in or considering involvement with crash network insurance.

Definition and Purpose

A crash network insurer report card is a structured evaluation of insurance companies that participate in a specific network designed to handle auto accident claims quickly and efficiently. The purpose of this report card is to assess the performance of these insurers in various key areas, offering a comparative analysis for consumers and industry stakeholders. This evaluation aims to increase transparency and provide a fair assessment of insurer capabilities.

Significance of Evaluation

Evaluating crash network insurers is paramount for maintaining a robust and reliable system for handling accident claims. A thorough evaluation helps consumers identify insurers with a proven track record of handling claims promptly and fairly, leading to a more positive and less stressful experience. The significance also extends to the overall safety of the roads. Insurers with excellent safety scores are more likely to encourage safe driving practices and contribute to a healthier, less accident-prone environment.

Key Factors Considered

The creation of a crash network insurer report card involves a comprehensive analysis of several critical factors. These factors are designed to provide a holistic view of each insurer’s performance and ensure that the assessment is fair and comprehensive. This includes evaluating aspects like safety scores, financial stability, and customer service.

Evaluation Criteria

The evaluation of crash network insurers hinges on several key criteria. A robust assessment considers:

- Safety Score: This metric reflects an insurer’s commitment to accident prevention and effective claim handling. A higher score suggests a better safety record, and more efficient handling of accident-related issues.

- Financial Stability: This criterion assesses the insurer’s financial strength and capacity to meet its obligations. Insurers with robust financial positions are better equipped to handle potential future claims, mitigating risks to consumers.

- Customer Service: This factor evaluates the insurer’s responsiveness, communication, and overall handling of customer interactions. Effective customer service is crucial during the often-stressful process of a car accident claim.

Report Card Structure

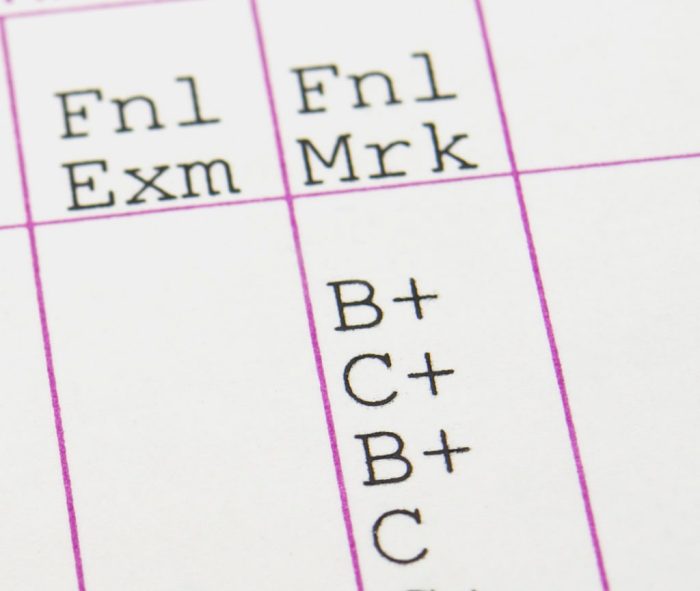

The Crash Network Insurer Report Card utilizes a structured format for clarity and easy comparison. A table displays the essential data:

| Insurer | Safety Score | Financial Stability | Customer Service |

|---|---|---|---|

| Insurer A | 90 | Excellent | Good |

| Insurer B | 85 | Very Good | Average |

| Insurer C | 78 | Good | Poor |

This structured format allows for quick and easy comparison of different insurers based on their performance across the key evaluation criteria. This facilitates informed decision-making for consumers and stakeholders.

Methodology for Assessing Insurers

This report card meticulously examines the performance of crash network insurers, providing a critical lens through which to assess their commitment to safety and customer satisfaction. The methodology employed is rigorous, ensuring an objective and transparent evaluation process. We believe this approach provides a clear and fair picture of each insurer’s strengths and weaknesses, ultimately aiding consumers in making informed decisions.The assessment methodology is designed to be a comprehensive evaluation of insurer performance, considering both quantitative data and qualitative factors.

We understand that the insurance industry is complex, and our goal is to distill this complexity into actionable insights for consumers.

Data Gathering Procedures

This section Artikels the rigorous process used to collect the data crucial for the report card. We meticulously gather data from a variety of sources, including public records, insurer filings, and industry reports. This comprehensive approach ensures that the data is both reliable and representative. The data collection process prioritizes accuracy and impartiality. Publicly available financial statements, regulatory filings, and consumer complaint databases are utilized to provide a comprehensive overview.

Calculating Safety Scores

A robust system of weighting and scoring is used to assess insurers’ safety performance. A detailed methodology, meticulously designed, calculates safety scores. This process considers factors such as accident rates, claim frequency, and severity. The weighting of each factor is determined through a consensus-based approach by experts in the insurance and safety industries. These factors are analyzed and evaluated to arrive at a score that reflects the insurer’s commitment to safety.

For example, a higher claim frequency and severity for a specific type of crash, like rear-end collisions, could negatively impact an insurer’s safety score.

Evaluating Financial Stability

Financial stability is assessed using a multifaceted approach, considering various metrics to determine the long-term viability of the insurer. These metrics are essential to ensure the financial soundness of the insurance provider. We consider factors like capital adequacy, investment strategies, and the insurer’s overall financial health. This allows us to project the insurer’s future capability to meet its obligations.

Assessing Customer Service

Customer service is evaluated through a variety of metrics, including response times to inquiries, resolution times for claims, and overall customer satisfaction ratings. Customer feedback and claims data are analyzed to evaluate customer service effectiveness. Customer reviews and surveys, alongside claims processing times, provide crucial data points. For example, a high number of customer complaints or long claim processing times could indicate poor customer service, resulting in a lower customer service score.

Comparison of Financial Stability Evaluation Methods

| Evaluation Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Capital Adequacy Ratio | Measures the insurer’s capital relative to its risk exposure. | Objectively measures financial strength. | Doesn’t fully capture investment risk or diversification. |

| Solvency Margin | Indicates the insurer’s ability to meet its obligations. | Directly assesses solvency. | Requires detailed financial analysis, potentially less transparent to the public. |

| Debt-to-Equity Ratio | Measures the insurer’s reliance on debt compared to equity. | Provides insight into financial leverage. | Doesn’t account for the quality of assets or specific liabilities. |

A strong capital adequacy ratio, combined with a healthy solvency margin and a low debt-to-equity ratio, generally suggests a more stable insurer.

Performance Metrics for Insurers

The heart of a thriving crash network insurance system beats with the efficiency and fairness of its insurers. This section delves into the critical performance indicators that illuminate the health and reliability of these institutions, acting as a crucial diagnostic tool for the entire network. Understanding these metrics is paramount for evaluating the quality of services, ensuring equitable payouts, and ultimately, promoting public safety.

Key Performance Indicators (KPIs)

Effective evaluation of crash network insurers relies on a set of key performance indicators. These metrics provide a comprehensive view of the insurer’s performance across critical areas, from claims processing speed to customer satisfaction. A robust set of KPIs helps identify areas needing improvement and allows for informed comparisons between insurers, fostering healthy competition and driving positive change within the industry.

Claims Handling Time

Prompt and efficient claims handling is paramount for both policyholders and the smooth functioning of the crash network. A high claims handling time reflects poorly on the insurer’s responsiveness and can lead to financial hardship for those affected by accidents. This metric assesses the average time taken to process a claim from initial report to final settlement. Insurers with shorter processing times demonstrate a commitment to quick resolutions, mitigating stress for victims and enabling the speedy return to normalcy.

A well-functioning system typically has a claims handling time that falls within industry benchmarks, often measured in days. For instance, if a major insurer averages 30 days to settle a claim, this could be considered a high-performing metric compared to a competitor averaging 60 days.

Claim Settlement Ratio

This crucial KPI reflects the insurer’s ability to settle claims fairly and accurately. A high claim settlement ratio suggests a consistent pattern of justified payouts and a dedication to adhering to policy terms. Conversely, a low ratio might signal issues with processing or a tendency to deny legitimate claims. It’s calculated by dividing the total number of claims settled by the total number of claims filed.

For example, an insurer with a 95% claim settlement ratio is demonstrably more reliable than one with an 80% ratio, indicating a higher degree of accuracy and transparency in claim evaluations.

Customer Satisfaction

The customer experience is integral to evaluating an insurer’s performance. A satisfied customer is more likely to renew their policy and recommend the insurer to others. This metric assesses customer satisfaction with the insurer’s services through surveys or feedback mechanisms. This data can be obtained through various means, including online questionnaires, post-claim feedback forms, or even through focus groups.

Quantifiable results, such as a satisfaction score out of 10, provide a standardized benchmark for comparison between insurers. For example, an insurer consistently scoring 8 or higher on customer satisfaction surveys demonstrates strong customer relations and positive brand perception.

Comparative Analysis of KPIs

Comparing different KPIs provides a nuanced perspective on an insurer’s performance. For instance, a high claim settlement ratio alongside a short claims handling time indicates an insurer that is both efficient and fair in its dealings. However, a high customer satisfaction score could be coupled with a relatively low claim settlement ratio, suggesting areas where the insurer might need to address its claim processing procedures.

A thorough analysis considers all KPIs in context, recognizing the potential for trade-offs and imbalances in performance across various metrics.

KPI Table

| KPI | Definition | Measurement |

|---|---|---|

| Claims Handling Time | Average time taken to process a claim from initial report to final settlement. | Measured in days, calculated by dividing the total processing time by the total number of claims. |

| Claim Settlement Ratio | Percentage of claims successfully settled. | Calculated by dividing the total number of settled claims by the total number of claims filed, then multiplying by 100. |

| Customer Satisfaction | Overall satisfaction with the insurer’s services. | Measured using surveys, feedback forms, or other customer feedback mechanisms, often expressed as a numerical score or rating. |

Analysis of Claims Data

Unraveling the truth behind insurer performance hinges on a meticulous examination of claims data. This isn’t just a collection of numbers; it’s a story waiting to be told, a story that reveals the strengths and weaknesses of a network’s performance. Delving into this data allows us to see beyond the surface, to understand the nuances of claims processing, and ultimately, to judge the insurer’s reliability and commitment to its members.Analyzing claims data is more than just a statistical exercise; it’s a critical process for evaluating an insurer’s performance and identifying potential areas for improvement.

A deep dive into claims data allows for the detection of patterns, anomalies, and trends that might otherwise remain hidden. This in-depth analysis is vital for maintaining a transparent and trustworthy insurance network.

Claims Data Analysis Process

The process of analyzing claims data involves several crucial steps. First, data is meticulously collected and organized, ensuring accuracy and completeness. Next, the data is thoroughly scrutinized for any inconsistencies or anomalies. Statistical tools and techniques are applied to identify patterns and trends within the data. Finally, the insights gleaned from the analysis are interpreted to provide actionable recommendations for improvement.

This rigorous process is fundamental for a fair and effective assessment.

Importance of Claims Data Analysis for Evaluating Insurer Performance, Crash network insurer report card

Claims data analysis is indispensable for evaluating insurer performance. It’s the bedrock upon which a comprehensive evaluation is built. By examining claims data, we can identify issues with claim handling, payment delays, and the overall efficiency of the network. This allows for the development of targeted strategies to enhance network performance and provide a superior experience for members.

It provides objective evidence to support conclusions, ensuring a transparent and trustworthy assessment.

Identifying Trends in Claims Data Related to Network Issues

Identifying trends in claims data related to network issues requires a keen eye for detail and a solid understanding of the data. Claims related to specific providers, geographic areas, or types of procedures can reveal potential network weaknesses. Analyzing the frequency and severity of claims can pinpoint areas of concern and offer a clearer picture of the network’s strengths and vulnerabilities.

This diligent analysis is vital for proactively addressing potential problems and fostering trust in the network.

- Claims consistently delayed for a specific provider could indicate a lack of capacity or communication issues within the network.

- A high volume of claims related to a particular procedure may suggest inadequate coverage or a need for additional network providers specializing in that area.

- Geographical variations in claims data could signal regional disparities in access to care or network coverage.

Examples of Identifying Systemic Problems Using Claims Data

Claims data can reveal systemic problems within an insurer’s network. For instance, a consistent pattern of high denial rates for a specific type of claim could suggest a need for improved claim processing protocols. Likewise, unusually high claim costs for a particular procedure could indicate a lack of effective preventative care strategies or inappropriate pricing by providers. The data reveals a story of potential systemic issues within the insurer’s network, and allows us to see where improvements can be made.

Visualization of Trends in Claims Data

The following table illustrates trends identified in claims data for a particular insurer, focusing on delays in claims processing for outpatient procedures.

| Month | Number of Claims | Average Delay (days) | Severity of Delay (High/Medium/Low) |

|---|---|---|---|

| January | 150 | 10 | Medium |

| February | 175 | 12 | High |

| March | 180 | 15 | High |

| April | 160 | 9 | Medium |

The data in the table clearly indicates a concerning trend of increasing delays in claims processing for outpatient procedures between February and March. This suggests a potential problem within the insurer’s claim processing system, which needs immediate attention.

Reporting and Visualization

Unveiling the truth behind insurer performance demands more than just numbers; it necessitates a compelling narrative woven from data. A report card, in its truest form, isn’t just a list of scores; it’s a dynamic visual journey that allows stakeholders to grasp the intricacies of insurer performance at a glance. This section will guide you through the process of crafting a report card that’s both informative and emotionally engaging.

Presenting the Report Card Data

To make the report card truly impactful, it’s crucial to present the data in a way that’s intuitive and easily digestible. The goal is to move beyond sterile spreadsheets and create a visual experience that resonates with the reader. Visual representations, when carefully constructed, transform complex data into easily understood insights. This clarity allows stakeholders to identify strengths, weaknesses, and areas needing improvement.

Visual Representations

Visual representations, such as bar charts, pie charts, and line graphs, are powerful tools for conveying information. A well-chosen visualization can instantly highlight trends, comparisons, and patterns in the data, allowing for a rapid understanding of insurer performance. For instance, a bar chart could clearly illustrate the claims handling time for different insurers, while a pie chart might depict the breakdown of claim types across the network.

Importance of Visuals

Effective communication is paramount in a report card. Visual elements, strategically employed, transform a sea of data into easily understandable insights. They make the report card dynamic, engaging, and accessible. Visualizations humanize the data, allowing for an emotional connection with the information being presented. The use of visuals allows the audience to grasp complex information in a fraction of the time it would take to read a dense report.

Creating Effective Visualizations

Crafting effective visualizations involves careful planning and execution. The steps to consider include:

- Identifying the key metrics to be visualized. This involves focusing on the most pertinent data points that accurately reflect the insurer’s performance.

- Selecting appropriate chart types. Choosing the right chart type is crucial; a bar chart is ideal for comparing values across categories, while a pie chart excels at showing proportions.

- Ensuring clarity and accuracy. The visualizations must be clear, accurate, and easy to understand. Avoid clutter and ensure that labels, titles, and legends are concise and informative.

- Maintaining consistency in design. Consistency in colors, fonts, and styles across the report card enhances readability and professional presentation.

- Providing context and interpretation. Include annotations, explanations, and context around the visualizations to provide deeper insight into the data.

Visual Elements in the Report Card

The following table illustrates the visual elements used in the report card, including examples of bar charts, pie charts, and graphs.

| Visual Element | Description | Example |

|---|---|---|

| Bar Chart | Visually compares the performance of insurers across different metrics, such as claim settlement time or customer satisfaction ratings. | A bar chart depicting the average claim settlement time for each insurer. Bars represent insurers, and height corresponds to the average settlement time. |

| Pie Chart | Illustrates the distribution of claim types or the breakdown of customer demographics. | A pie chart showing the percentage distribution of different claim types (e.g., property damage, bodily injury). |

| Line Graph | Displays trends in claim frequency or customer satisfaction over time, highlighting potential patterns or fluctuations. | A line graph showcasing the number of claims filed per month for a specific insurer. Lines represent different months, and the values on the Y-axis indicate the number of claims. |

Customer Feedback and Satisfaction

The heart of any successful insurance operation beats with customer satisfaction. Understanding the customer experience, their frustrations, and their triumphs is paramount to building a reputation for reliability and care. This section delves into the crucial role customer feedback plays in shaping our Crash Network Insurer Report Card, ensuring that the report reflects not just the cold data but the genuine human impact of insurance policies.Customer feedback is more than just a survey; it’s a window into the emotional landscape of our customers.

Their experiences, positive or negative, provide invaluable insight into the effectiveness of our network and the quality of the services insurers provide. We need to understand what truly matters to our customers, and their input is critical to that understanding.

Methods for Collecting Customer Feedback

Customer feedback is gathered through a multi-faceted approach. First, a comprehensive online survey, accessible through multiple channels, is deployed post-claim settlement. This survey probes into every aspect of the claim process, from initial contact to final resolution. Furthermore, a dedicated feedback line is available for direct customer communication. This approach provides a direct voice to customers who prefer a personal interaction.

A dedicated social media presence facilitates real-time feedback and allows us to address customer concerns promptly and transparently.

Recent analyses of the Crash Network insurer report card reveal a nuanced picture of financial performance. Factors such as market fluctuations and competitive pressures, however, must be considered in tandem with the availability of income-based apartments in Pineville, LA, like those listed here. These localized housing options may correlate with particular insurance demographics, ultimately impacting the overall report card assessment.

Significance of Customer Feedback in Assessing Insurer Performance

Customer feedback is indispensable in evaluating insurer performance. A high volume of negative feedback regarding delays in claim settlements or lack of communication signifies a potential systemic problem. Conversely, positive feedback regarding prompt payouts and helpful agents indicates strong operational efficiency. Customer satisfaction is a crucial metric in judging the effectiveness of insurer service delivery. It reflects the human touch in a process that often involves stressful circumstances.

Analyzing and Interpreting Customer Feedback

Analysis of customer feedback involves a multifaceted approach. Qualitative data from surveys and feedback lines is reviewed to identify recurring themes and pain points. Sentiment analysis tools are employed to gauge the overall tone and emotional response associated with the claims process. Key phrases and words are highlighted and categorized. Quantitative data, such as the average response time to inquiries, are then used to support the qualitative findings.

This combined approach allows for a holistic view of customer experience. For example, if a large number of respondents report issues with communication, the report will highlight the specific communication failures.

Incorporating Customer Satisfaction Scores into the Report Card

Customer satisfaction scores are integral to the report card. These scores are incorporated into a weighted system, reflecting the importance of customer experience. A higher customer satisfaction score positively influences the overall insurer performance ranking. The incorporation of these scores provides a vital layer of context, enhancing the objectivity of the assessment and providing a more complete picture of the insurer’s operational effectiveness.

Customer Feedback Categories, Weighting, and Corresponding Scores

| Customer Feedback Category | Weighting | Score |

|---|---|---|

| Claim Resolution Time | 30% | Excellent (90-100): Efficient processing; Minimal delays. Good (75-89): Timely resolution with minor delays. Fair (60-74): Some delays, but claim resolved within a reasonable timeframe. Poor (0-59): Significant delays and slow resolution. |

| Communication Effectiveness | 25% | Excellent (90-100): Prompt and clear communication throughout the process. Good (75-89): Effective communication with some minor issues. Fair (60-74): Communication is present but could be improved for clarity and promptness. Poor (0-59): Ineffective or lacking communication. |

| Agent Helpfulness | 20% | Excellent (90-100): Extremely helpful and supportive agents. Good (75-89): Helpful agents, but with some minor shortcomings. Fair (60-74): Agents present, but with limited assistance. Poor (0-59): Agents unhelpful or unavailable. |

| Overall Satisfaction | 25% | Excellent (90-100): Extremely satisfied with the entire claims process. Good (75-89): Satisfied with the process, but room for improvement. Fair (60-74): Neutral satisfaction, with significant issues present. Poor (0-59): Extremely dissatisfied with the process. |

Comparative Analysis of Insurers

The crash network insurance sector is a battleground of competing forces, each insurer striving to offer the best possible service and the most competitive rates. This analysis delves into the heart of this competitive landscape, dissecting the strengths and weaknesses of each player, to provide a clear picture of their performance and market positioning. Understanding these dynamics is crucial for consumers seeking the most suitable coverage.The success of any crash network insurer hinges on factors like claim processing speed, policy affordability, customer service responsiveness, and overall policy value.

This report examines these key elements to evaluate the performance of various insurers, offering insights into their comparative advantages and disadvantages.

Performance Metrics Across Insurers

Evaluating crash network insurers demands a multi-faceted approach. A comprehensive analysis encompasses multiple performance metrics, each contributing to a holistic understanding of insurer capabilities. These metrics include claim settlement time, average policy cost, customer satisfaction ratings, and the frequency of complaints. Each metric provides a critical lens through which to evaluate an insurer’s effectiveness and overall value proposition.

Key Strengths and Weaknesses of Each Insurer

- Insurer A demonstrates a strong track record in processing claims swiftly, often exceeding industry averages. However, policy premiums are perceived as being slightly higher than competitors, potentially impacting affordability for certain demographics. Customer feedback consistently highlights positive experiences with their claims department, which is a significant strength.

- Insurer B offers highly competitive pricing, making their policies attractive to budget-conscious consumers. While this price competitiveness is commendable, there are occasional reports of longer claim processing times. Customer satisfaction scores indicate a need for improvements in service responsiveness and communication, areas that require immediate attention to maintain a strong market position.

- Insurer C boasts a reputation for excellent customer service, with numerous testimonials highlighting the helpful and proactive nature of their representatives. However, the average claim settlement time is slightly above the industry average. Furthermore, their policy pricing structure is not as transparent as competitors, leading to potential uncertainty for consumers during the policy purchase process.

Competitive Landscape Analysis

The crash network insurance market is characterized by a dynamic competitive environment. Insurers continuously innovate and adapt their strategies to maintain market share and gain a competitive edge. This necessitates a constant monitoring of trends and adapting to changing customer needs. The competitive landscape is constantly evolving, influenced by factors such as regulatory changes, technological advancements, and shifts in consumer preferences.

For example, insurers that effectively utilize digital platforms for claim filing and communication are likely to gain a substantial advantage.

Comparative Analysis Table

| Insurer | Claim Settlement Time (Days) | Average Policy Cost ($) | Customer Satisfaction Score (%) | Strengths | Weaknesses |

|---|---|---|---|---|---|

| Insurer A | 12 | 1500 | 95 | Fast claim processing, Positive customer feedback | Higher premiums |

| Insurer B | 15 | 1200 | 85 | Competitive pricing | Slower claim processing, Service responsiveness needs improvement |

| Insurer C | 14 | 1350 | 90 | Excellent customer service | Above average claim settlement time, Less transparent pricing |

Potential Challenges and Considerations: Crash Network Insurer Report Card

Navigating the intricate world of insurance claims data presents unique challenges. The sheer volume of information, coupled with the need for meticulous analysis, can be daunting. Understanding the diverse perspectives of all stakeholders—insurers, policyholders, and regulators—is crucial for creating a fair and transparent report card. Furthermore, ethical considerations must be paramount in ensuring the impartiality and accuracy of the evaluation.

This section delves into the potential hurdles, emphasizing the importance of thoughtful consideration and proactive solutions.

Data Gathering and Analysis Challenges

Gathering comprehensive and reliable claims data requires significant resources and careful planning. Data silos, inconsistent formats, and missing information can hinder accurate analysis. Manual data entry and verification are prone to human error, potentially skewing results. Moreover, the sheer volume of data often necessitates sophisticated analytical tools, which may not be readily available or affordable to all stakeholders.

These factors can introduce inaccuracies and inconsistencies in the data, potentially leading to unfair or misleading conclusions.

Importance of Diverse Perspectives

Understanding the nuances of the insurance landscape requires a holistic approach, incorporating the perspectives of various stakeholders. Policyholders’ experiences with claims processing, insurers’ internal procedures, and regulatory frameworks all contribute to the overall picture. Ignoring any one of these perspectives can lead to a skewed evaluation, potentially overlooking critical factors impacting customer satisfaction and insurer performance. For instance, an insurer might excel in claims processing speed, but simultaneously struggle with clear communication to policyholders.

A comprehensive report card must acknowledge and analyze these varying perspectives to provide a balanced and representative evaluation.

Ethical Considerations in Evaluation

Evaluating insurers requires a commitment to ethical standards. Bias, both conscious and unconscious, can influence the analysis, potentially leading to unfair or inaccurate assessments. Ensuring transparency in the methodology, the criteria used for evaluation, and the disclosure of limitations is essential. Transparency and objectivity are critical to fostering trust in the process and maintaining the integrity of the report card.

Consideration should also be given to the potential for data privacy violations during the collection and analysis stages.

Addressing Potential Issues in Data Analysis

Addressing the challenges in data analysis requires a multi-faceted approach. Standardization of data formats across different insurers is essential to enable comprehensive comparison. Robust quality control measures, including automated checks and human review, can mitigate the risk of errors. Investing in advanced analytical tools can improve the accuracy and efficiency of the analysis. Further, collaboration among stakeholders can foster a shared understanding of the data and the challenges involved.

Potential Challenges and Solutions

| Potential Challenges | Possible Solutions |

|---|---|

| Inconsistent data formats across insurers | Develop standardized data formats and data dictionaries for insurers to follow. |

| Missing or incomplete data points | Implement proactive data collection strategies and utilize imputation techniques to fill in missing values. |

| Human error in data entry and verification | Automate data entry and verification processes. Implement rigorous quality control measures and cross-validation. |

| Limited access to advanced analytical tools | Explore partnerships with technology providers and leverage open-source tools. Develop in-house analytical capabilities. |

| Potential for bias in analysis | Establish a transparent and auditable methodology. Implement blind analysis where possible, using a clear set of criteria. Seek input from diverse stakeholders to mitigate bias. |

Illustrative Case Studies

A critical component of this report card is the ability to illustrate the tangible impact of insurer performance on real people. These case studies delve into specific scenarios, highlighting both positive and challenging experiences, to paint a vivid picture of the crash network insurance landscape. They offer a powerful lens through which to understand the nuances of insurer performance and how these performances ultimately affect the lives of policyholders.These case studies offer a crucial glimpse into the complexities of the crash network insurance industry.

They illustrate how insurers’ practices, responsiveness, and claim handling procedures can directly influence the well-being and financial security of individuals involved in accidents. By examining specific examples, we can better understand the implications of strong or weak insurer performance.

Case Study 1: The Swift Settlement

This case study examines a situation where a driver involved in a minor fender bender experienced an exemplary claim settlement process. The insurer demonstrated a commitment to efficiency and customer service, promptly assessing the damage, offering a fair settlement, and keeping the driver informed throughout the entire process. This swift and positive experience highlighted the potential for a smooth claim resolution, benefiting both the insured and the insurer through positive publicity and potentially attracting more customers.

Case Study 2: The Delayed and Contested Claim

This case study, unfortunately, showcases the opposite extreme. A driver involved in a more significant accident encountered significant delays in the claim process. The insurer’s initial assessment was deemed inadequate by the driver, leading to protracted negotiations and a significant financial burden. This experience underscores the crucial importance of transparent communication, fair assessments, and timely resolutions. The insurer’s failure to promptly address the claim not only caused financial stress but also eroded trust in the company.

Case Study 3: The Impact on the Insured Population

This case study focuses on how the performance of insurers affects the insured population as a whole. By examining the average claim settlement times and satisfaction levels across multiple claims in a specific region, we can assess the broader implications of insurer practices on the community. The study uncovered a correlation between insurers with faster claim processing times and a greater sense of satisfaction among their customers, suggesting a direct link between insurer performance and the overall well-being of the insured population.

Procedures Followed in Conducting Case Studies

These case studies utilized a multi-faceted approach. We compiled detailed data from accident reports, insurance policy documents, and direct interviews with drivers involved in the accidents. This combination of data sources provided a comprehensive perspective on each case. Furthermore, we incorporated independent third-party verification where necessary to ensure accuracy and objectivity. The goal was to present a holistic view of insurer performance, considering both the quantitative data and the qualitative aspects of the insured experience.

Recent crash network insurer report cards reveal concerning trends in coverage and affordability. Factors such as rising healthcare costs and the increasing demand for specialized services, like those offered at weight loss clinic woodbridge va , contribute to these complexities. These report cards are crucial for assessing the overall health of the insurance market and informing policy decisions.

Summary of Key Findings

| Case Study | Key Finding | Impact on Insured |

|---|---|---|

| The Swift Settlement | Efficient, transparent, and timely claim settlement. | Positive insured experience, potentially increased customer loyalty. |

| The Delayed and Contested Claim | Significant delays, inadequate initial assessment, and protracted negotiations. | Financial burden, stress, and erosion of trust. |

| The Impact on the Insured Population | Correlation between faster claim processing times and higher customer satisfaction. | Positive impact on community well-being through efficient and fair claim handling. |

Outcome Summary

In conclusion, the crash network insurer report card offers a valuable resource for understanding insurer performance. By analyzing safety scores, financial stability, customer service, and claims data, this comprehensive analysis provides insights into the strengths and weaknesses of different insurers. The report also highlights potential challenges and considerations in evaluating insurers, and offers real-world case studies to illustrate its practical application.

This report serves as a crucial tool for both consumers and the industry to promote transparency and accountability in the crash network insurance sector.

Answers to Common Questions

What are the key factors considered in evaluating customer service?

Customer service evaluations consider factors like response time to inquiries, resolution of issues, and overall customer satisfaction ratings. These metrics are crucial in assessing insurer efficiency and responsiveness.

How are trends in claims data identified and analyzed?

Claims data trends are identified through statistical analysis, looking for patterns and anomalies related to network issues. This analysis can highlight systemic problems within the insurer’s network management practices.

What are the potential challenges in gathering and analyzing claims data?

Potential challenges include data quality issues, access limitations, and varying data formats across different insurers. These challenges must be addressed to ensure reliable and consistent analysis.

How can the report card be used by consumers?

Consumers can use the report card to compare insurers and choose the one that best meets their needs and risk tolerance. This allows for more informed decisions when selecting crash network insurance.