Per stirpes in life insurance dictates how policy benefits are distributed when a beneficiary dies before the insured. Understanding this crucial aspect is essential for ensuring your loved ones receive the intended inheritance. This guide delves into the intricacies of per stirpes, comparing it to per capita distribution, and outlining the legal and tax implications.

This detailed exploration will cover beneficiary designations, the impact of a beneficiary’s death, tax considerations, legal implications, practical examples, and alternatives to per stirpes. Equipped with this knowledge, you can make informed decisions about your life insurance policy and safeguard your loved ones’ financial future.

Definition and Meaning of “Per Stirpes” in Life Insurance

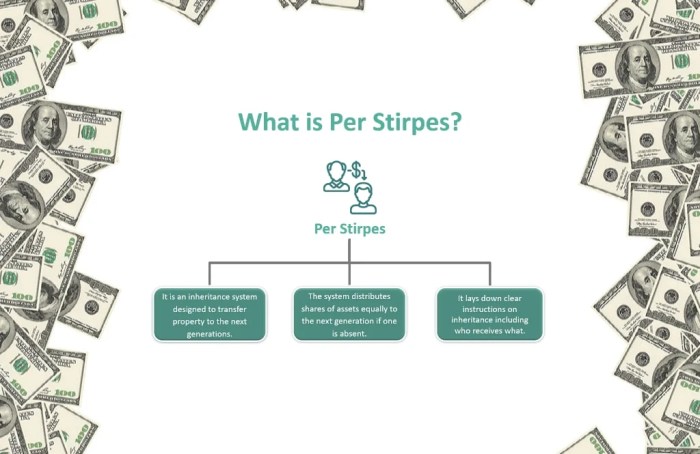

In life insurance policies, “per stirpes” is a crucial distribution method that dictates how benefits are allocated among beneficiaries. It’s a Latin term that essentially means “by the branch.” This contrasts with “per capita,” a different approach to distributing assets. Understanding the nuances between these two methods is vital for beneficiaries to receive the intended portion of the policy’s payout.

Per Stirpes Distribution Explained

“Per stirpes” distribution prioritizes the surviving descendants of a deceased beneficiary. Instead of dividing the payout equally among all beneficiaries, it divides the estate among the surviving children of the deceased. Each child receives a share of their deceased parent’s portion, regardless of whether the parent had other children. This ensures that the descendants of a deceased beneficiary aren’t overlooked or unfairly disadvantaged in the distribution process.

Per Stirpes vs. Per Capita Distribution

The fundamental difference lies in how the estate is divided. “Per stirpes” distribution allocates the deceased’s share to their descendants. “Per capita” distribution, conversely, divides the estate equally among all beneficiaries, regardless of any familial connections. The “per stirpes” method is often favored for its fairness in distributing assets to the next generation, preventing a deceased beneficiary’s share from being diluted by the addition of other beneficiaries.

Application of Per Stirpes Distribution

Per stirpes distribution is applied to life insurance policies in various ways. Consider a scenario where a policyholder designates their spouse as the primary beneficiary and their children as contingent beneficiaries. If the spouse predeceases the policyholder, the policy’s payout will be distributed among the surviving children, with each child inheriting the portion that would have belonged to their deceased parent.

This ensures that the children inherit their parent’s portion of the estate, even if the parent is deceased. Another example is where a policyholder designates their children as beneficiaries. If one child dies before the policyholder, their share is passed on to their own children.

Comparison Table: Per Stirpes vs. Per Capita

| Feature | Per Stirpes | Per Capita |

|---|---|---|

| Distribution | Distributed among surviving descendants of the deceased beneficiary. | Distributed equally among all beneficiaries. |

| Impact on Children | Children inherit their deceased parent’s share. | Each child receives an equal share, regardless of the deceased parent. |

Beneficiary Designations and “Per Stirpes”

Choosing the right beneficiaries for your life insurance policy is crucial, and “per stirpes” distribution adds another layer of complexity. This method dictates how benefits are divided among beneficiaries, particularly when dealing with deceased beneficiaries or those with children. Understanding how to designate beneficiaries using “per stirpes” ensures your wishes are accurately carried out, avoiding potential disputes and delays down the road.

Knowing your options is key to securing your loved ones’ future.

Beneficiary Designation Process

To designate beneficiaries using “per stirpes,” you must clearly specify this method within your life insurance policy. This often involves using specific terminology in the beneficiary designation form. Your insurance provider will have a standardized form, and using this form correctly is critical to ensuring your intent is clear.

Importance of Clear Designations, Per stirpes in life insurance

Accurate beneficiary designations are paramount in life insurance. A lack of clarity or ambiguity can lead to prolonged legal battles and financial hardship for your beneficiaries. Imagine the emotional and financial turmoil caused by a contested claim. The proper designation process ensures a smooth transition of benefits and prevents future conflict.

Examples of “Per Stirpes” Designations

Consider these examples illustrating “per stirpes” distribution:

- Example 1: John designates his wife, Mary, as the primary beneficiary. If Mary predeceases John, and John has two children, the children will receive the benefits in equal shares. This avoids leaving the estate to a more distant relative.

- Example 2: Sarah designates her two children, Emily and David, as beneficiaries. If one child, Emily, passes away before Sarah, Emily’s children will inherit her portion of the benefits, distributing the estate proportionally.

- Example 3: A parent designates their three children as beneficiaries, and one of the children passes away, leaving behind a child of their own. The surviving child of the deceased child will receive the deceased child’s share of the benefits. The surviving children will receive the remaining shares.

Potential Complications from Improper Designations

| Scenario | Potential Complications |

|---|---|

| Missing or unclear designations | Disputes and delays in claim processing. The insurance company may need to involve legal counsel, leading to increased costs and prolonged resolution times. This can be extremely stressful for grieving beneficiaries. |

| Inaccurate designations | Incorrect distribution of benefits. A family member may not receive the intended portion, creating financial hardship and resentment. This is especially concerning if the error affects the share of a minor. |

These potential complications highlight the critical need for meticulous beneficiary designation. A well-drafted designation using “per stirpes” ensures a smooth and equitable distribution of benefits, minimizing disputes and financial burdens for all involved.

Impact of Deceased Beneficiary on “Per Stirpes” Distribution

A crucial aspect of per stirpes distribution in life insurance is understanding how the death of a beneficiary affects the inheritance process. This isn’t a simple straight line; it involves the concept of representation, ensuring the deceased beneficiary’s share is passed down to their heirs. This intricate system ensures that the intended beneficiaries ultimately receive the designated portions.

The Impact of a Beneficiary’s Premature Death

When a beneficiary dies before the insured, their designated share in the policy isn’t lost to the void. Instead, the per stirpes rule dictates that the deceased beneficiary’s share is distributed to their own heirs. This representation ensures the deceased beneficiary’s intended heirs inherit their share, maintaining the original intent of the policy.

Representation in Per Stirpes Distribution

The core principle of per stirpes is representation. It means that the deceased beneficiary’s children (or grandchildren, if the beneficiary has no children) step into their parent’s shoes. This ensures that the intended heirs receive the portion that was originally designated for the deceased beneficiary.

Illustrative Examples of Deceased Beneficiary Impact

Consider a scenario where the insured names their child, Alex, as a beneficiary. Alex, however, passes away before the insured. If Alex has a child, Lily, Lily will receive the share that Alex would have received had he lived.

Per stirpes in life insurance means benefits are split among beneficiaries according to the insured’s family tree. It’s a crucial element of policy design, making sure funds go to the right people. However, it’s important to consider things like if a product like Dazzle Dry is actually good for your nails before making important financial decisions; is dazzle dry good for your nails is a great resource to explore.

Ultimately, understanding per stirpes is essential for sound estate planning, especially when beneficiaries are not directly related to the insured.

Another example: Assume a parent names two children, Sarah and John, as beneficiaries, each receiving an equal share. If John predeceases the parent, his share will be distributed to his children, proportionally dividing the original portion of the policy between them. The distribution process ensures the inheritance aligns with the original intent, avoiding gaps and uncertainties.

A Flowchart Illustrating the Distribution Process

The flowchart below visually depicts the distribution process when a beneficiary dies before the insured, illustrating the concept of representation:

| Step | Description |

|---|---|

| 1 | Initial Designation: The insured designates beneficiaries (e.g., Alex, John). |

| 2 | Beneficiary Predeceases: Alex, one of the beneficiaries, dies before the insured. |

| 3 | Representation: Alex’s designated share is distributed to their heirs (e.g., Lily, Alex’s child). |

| 4 | Final Distribution: The remaining beneficiaries (e.g., John) receive their designated portions. Lily receives Alex’s portion. |

Tax Implications of “Per Stirpes” Distribution in Life Insurance

Navigating the tax implications of life insurance payouts can be tricky, especially when the beneficiary designations involve a “per stirpes” distribution. This method, which prioritizes descendants of deceased beneficiaries, can significantly impact estate tax burdens and, potentially, create opportunities for tax optimization. Let’s dive into the intricacies of how per stirpes affects your tax situation.

Per stirpes distribution in life insurance policies, while seemingly straightforward in its allocation of benefits, can have a surprising impact on estate tax implications. Understanding these implications is crucial for beneficiaries to manage their tax obligations effectively. This section will examine the potential tax advantages and disadvantages, offering clarity in navigating these complex financial decisions.

Estate Tax Implications

Per stirpes distribution often affects the size of the estate subject to estate taxes. If a beneficiary dies before the policy payout, the portion intended for that beneficiary is distributed to their descendants, potentially reducing the taxable estate. However, this depends on the specific regulations of the jurisdiction and the policy’s terms.

Tax Advantages and Disadvantages

The tax advantages and disadvantages of per stirpes distribution vary greatly depending on the circumstances. One potential advantage is the reduction in the size of the taxable estate, leading to lower estate tax liabilities. Conversely, if the policy proceeds are substantial, a per stirpes distribution might trigger an estate tax liability for the beneficiaries’ estates. Careful estate planning is essential to mitigate any potential disadvantages.

Relevant Tax Codes and Regulations

Specific tax codes and regulations concerning life insurance and per stirpes distribution can vary significantly by jurisdiction. Consult with a qualified estate planning attorney or tax professional to understand the precise implications of these laws in your situation. The relevant tax codes and regulations are complex and involve specific provisions that determine the estate tax liability in situations with per stirpes distributions.

There’s no one-size-fits-all answer when it comes to the tax implications of per stirpes distributions. The interplay between the policy’s terms, the beneficiary’s circumstances, and the relevant tax laws makes careful planning crucial. Consult a qualified professional for personalized advice.

Legal Considerations and “Per Stirpes” Distribution

Navigating the intricacies of life insurance beneficiaries can be tricky, especially when “per stirpes” distribution is involved. This distribution method, while straightforward in its intent, can encounter legal hurdles and disputes, making it crucial to understand the underlying legal considerations. Understanding these factors empowers you to make informed decisions and potentially avoid future conflicts.Legal considerations for “per stirpes” distribution in life insurance policies encompass a range of factors, including the clarity of the policy language, the validity of the beneficiary designations, and the potential for disputes arising from changes in family circumstances or interpretations of the law.

A well-drafted policy, coupled with sound legal counsel, can significantly reduce the risk of future challenges.

Clarity of Policy Language and Beneficiary Designations

The language used in a life insurance policy to define “per stirpes” distribution is critical. Ambiguity in the policy wording can lead to disputes over who receives the benefits. Precise language is essential to avoid misunderstandings. For example, if the policy states “distribution to be made per stirpes to my children and their descendants,” it should specify how the distribution is to be handled if a child has passed away.

Potential Legal Challenges and Disputes

Disputes can arise when the intended beneficiaries of a “per stirpes” distribution change, or when there’s disagreement on the correct interpretation of the distribution method. These disputes might involve:

- Challenges to the validity of beneficiary designations: Beneficiary designations can be contested if they are deemed to be invalid or if they are not executed in accordance with the policy requirements.

- Disputes over the proper interpretation of “per stirpes”: Different jurisdictions may interpret “per stirpes” differently. The specific wording of the policy, combined with applicable state law, determines the correct interpretation.

- Changes in family circumstances: The death or disqualification of a beneficiary, or the birth of new descendants, can affect the distribution. The policy language must address such scenarios to avoid ambiguity.

- Disputes over the surviving beneficiaries’ rights: If a beneficiary predeceases the insured, the policy should clearly state how the benefits are to be distributed to the deceased beneficiary’s descendants.

Importance of Legal Advice

Seeking legal counsel regarding life insurance policies and “per stirpes” distribution is strongly advised. A qualified attorney specializing in estate planning or life insurance can help clarify the policy’s language, ensure the validity of the beneficiary designations, and advise on the potential for future challenges.

Examples of Court Cases

Unfortunately, providing specific examples of court cases is beyond the scope of this response. However, finding such examples through legal research databases or consulting with an estate planning attorney can provide valuable insight into how courts have addressed similar issues in the past. Such examples can help illustrate how legal precedent shapes the interpretation and application of “per stirpes” distribution.

Per stirpes in life insurance is a pretty straightforward concept, essentially how policy benefits are distributed if the primary beneficiary dies before the insured. Knowing the specifics of these arrangements is crucial for estate planning, and if you’re planning ahead for the Melbourne Garden Show 2025 dates, it’s good to have your affairs in order. Understanding your policy’s per stirpes provisions is a critical aspect of this, ensuring that your intended beneficiaries receive their share.

Melbourne Garden Show 2025 dates are important too, but the insurance piece is key.

Practical Application and Examples

Per stirpes distribution, a crucial element in life insurance beneficiary designations, ensures fair and equitable division of policy proceeds among beneficiaries, especially when family members pass away. Understanding its application in real-world scenarios is key to navigating the complexities of inheritance and legacy planning. Let’s explore some practical examples to clarify its implications.

Real-World Life Insurance Scenarios

Per stirpes distribution comes into play when a primary beneficiary predeceases the policyholder. Instead of the deceased beneficiary’s share going to someone else entirely, it is distributed to their descendants. This preserves the intent of the policyholder and avoids unintended consequences.

- Scenario 1: Simple Family Structure. John Smith takes out a life insurance policy naming his two children, Emily and David, as beneficiaries. Both are living when John passes away. However, Emily, in a tragic accident, predeceases John. Emily has two children, Sarah and Michael.

Under per stirpes, Emily’s share is divided between Sarah and Michael, her children. David receives his original share.

- Scenario 2: Complex Family Structure. Maria Rodriguez names her three children, Anna, Ben, and Carlos, as beneficiaries. Anna predeceases Maria, leaving behind two children, Sophia and Leo. Ben is alive, and Carlos passes away after Maria, leaving behind a child, Ethan. Per stirpes ensures that Maria’s estate is distributed proportionally among the remaining beneficiaries.

Sophia and Leo receive Anna’s share, Ben gets his own share, and Ethan receives Carlos’s share.

Impact on Different Family Structures

Per stirpes distribution acknowledges the varying needs and relationships within a family. It’s not just about the living, but about ensuring descendants inherit a portion of the policy benefits that would have otherwise been lost.

- Single-Parent Families. A single parent naming their child as beneficiary may want to consider per stirpes if the child has children of their own. Per stirpes will ensure the grandchildren receive a portion of the policy if the child were to predecease the parent.

- Families with Divorced Parents. If a divorced parent names their child as beneficiary and that child predeceases them, per stirpes can still guarantee the child’s share of the proceeds goes to their own descendants.

- Adopted Children. Adopted children are treated as biological children in per stirpes distribution.

Case Studies

These scenarios demonstrate the practical application of per stirpes distribution in various life insurance contexts.

| Case | Policyholder | Beneficiaries | Outcome (Per Stirpes) |

|---|---|---|---|

| 1 | Robert Miller | Son, Alex; Daughter, Sarah | Alex and Sarah each receive 50% of the proceeds. |

| 2 | Maria Garcia | Son, David; Daughter, Emily (deceased); Grandchildren, Sophia and Leo | David receives 50% of the proceeds. Sophia and Leo each receive 25% of the proceeds. |

| 3 | James Brown | Daughter, Jessica (deceased); Grandchildren, Chloe and Mia; Son, John | Chloe and Mia each receive 50% of Jessica’s share. John receives his original share. |

Alternatives to “Per Stirpes” Distribution in Life Insurance

Navigating the world of life insurance beneficiaries can feel like navigating a maze. Choosing the right distribution method is crucial for ensuring your loved ones receive the benefits you intended. “Per stirpes” is a common approach, but it’s not the only one. Let’s explore some alternatives, particularly “per capita,” to better understand your options.Understanding different distribution methods can empower you to make informed decisions, safeguarding your legacy and ensuring your loved ones’ financial well-being.

Per Capita Distribution

Per capita distribution divides the insurance proceeds directly among the beneficiaries, regardless of their familial relationships. Imagine a scenario where the insured has two children, one of whom has passed away, leaving behind two grandchildren. Under per capita, the living child and the two grandchildren would each receive an equal share of the proceeds. This differs significantly from per stirpes, where the deceased child’s share would be distributed to their descendants.

Comparison of Per Stirpes and Per Capita

Both “per stirpes” and “per capita” are methods for distributing life insurance proceeds, but they differ in how they handle the distribution among beneficiaries.

| Characteristic | Per Stirpes | Per Capita |

|---|---|---|

| Distribution Principle | Distributes to the nearest generation of living descendants. Shares are proportionally distributed among the living descendants of a deceased beneficiary. | Distributes equally among all living beneficiaries, regardless of their relationship to the insured. |

| Impact of Deceased Beneficiary | Distributes the deceased beneficiary’s share to their living descendants. | Ignores deceased beneficiaries and their descendants. The deceased beneficiary’s share is distributed amongst the remaining living beneficiaries. |

| Complexity | Can be more complex to administer, particularly when there are multiple generations of beneficiaries. | Generally simpler to administer because it does not involve calculating shares based on familial relationships. |

| Potential for Disagreement | May potentially lead to disagreements if beneficiaries feel their share is inequitable compared to other beneficiaries. | May potentially lead to disagreements if beneficiaries feel their share is inequitable compared to other beneficiaries. This may be more pronounced in cases where there are descendants of deceased beneficiaries. |

| Favorable Circumstances | Favorable when the insured desires to ensure their descendants receive the inheritance, especially when the descendants are in different generations. | Favorable when the insured wants to provide a more equal distribution to all living beneficiaries, irrespective of their relationship. |

Circumstances Favoring Per Stirpes

Per stirpes is often preferred when the insured wants to prioritize the descendants of deceased beneficiaries. A parent might choose per stirpes to ensure their grandchildren inherit a portion of their life insurance benefits, even if one of their children has passed away.

Circumstances Favoring Per Capita

Per capita distribution is often chosen when the insured wants to distribute the proceeds equally among all living beneficiaries. This might be preferred if the insured wants to give their children or other relatives an equal share, regardless of any deceased relatives. For example, a person might use per capita if they want to ensure that all living children receive an equal portion of the proceeds.

Conclusion

Choosing between “per stirpes” and “per capita” distribution requires careful consideration of the insured’s wishes and the specific circumstances of their beneficiaries. Understanding the nuances of each method will help you make an informed decision that aligns with your intentions and ensures the desired outcome for your loved ones.

Last Word

In conclusion, per stirpes in life insurance is a critical component of estate planning. Careful consideration of beneficiary designations, potential complications, and tax implications are vital for a smooth distribution process. Understanding the nuances of per stirpes, alongside alternatives like per capita, empowers individuals to create policies that accurately reflect their wishes and protect their beneficiaries. This guide has provided a comprehensive overview, offering valuable insights into navigating the complexities of life insurance beneficiaries.

Quick FAQs: Per Stirpes In Life Insurance

What is the difference between per stirpes and per capita distribution?

Per stirpes distribution divides benefits among surviving descendants, with each branch of the family receiving a share. Per capita distribution, on the other hand, divides benefits equally among all beneficiaries, regardless of family lineage.

What happens if a beneficiary dies before the insured?

The deceased beneficiary’s share is distributed to their surviving descendants. This is known as representation in per stirpes distribution. The specific distribution depends on the policy’s wording and the beneficiary designations.

Are there tax implications associated with per stirpes distribution?

Yes, per stirpes distribution can affect estate tax implications. Consult a tax professional to understand how it impacts your specific situation.

What are some common complications if beneficiaries aren’t properly designated?

Missing or unclear designations can lead to disputes and delays in claim processing, while inaccurate designations result in incorrect benefit distributions. This highlights the critical importance of accurate and comprehensive beneficiary designations.