Table rating for life insurance provides a crucial framework for evaluating different policies. Understanding these ratings empowers you to make informed decisions about your coverage. Different policies, from term to permanent, have varying ratings, reflecting the risks and benefits associated with each type. Factors like health, lifestyle, and age all play a significant role in determining your specific rating, influencing premiums and coverage options.

This guide will walk you through the intricacies of these ratings, helping you decipher the complexities of life insurance.

This comprehensive resource delves into the factors that influence life insurance table ratings, enabling you to compare different policies effectively. We’ll explore the methodologies behind these ratings, analyze different policy types, and examine how your health and lifestyle choices impact your premiums. Furthermore, we’ll compare different insurance providers and offer valuable tips for consumers evaluating life insurance options.

Introduction to Life Insurance Table Ratings

Yo, peeps! Life insurance, right? It’s like a safety net, but you gotta know what you’re getting. Table ratings are the key to figuring out which policy is right for your situation. They’re like a scorecard, telling you how much coverage you can expect and how much you’ll pay. Knowing these ratings helps you make smart choices, so you’re not getting ripped off.Life insurance table ratings are basically a system that ranks different policies based on factors like your health, age, and lifestyle.

Different types of policies have different ratings, and understanding these differences is crucial for choosing the best fit. Think of it like comparing different brands of sneakers – some are designed for running, others for casual wear. Each policy has its own strengths and weaknesses, and the table ratings help you see that.

Types of Life Insurance Policies

Life insurance comes in various forms, each with its own characteristics. Term life insurance is temporary coverage for a set period, while whole life insurance offers lifelong coverage with a cash value component. Variable life insurance allows for investment options, but comes with more complexity and potential for loss. Understanding these differences helps you pick the policy that aligns with your needs and goals.

Factors Influencing Life Insurance Table Ratings

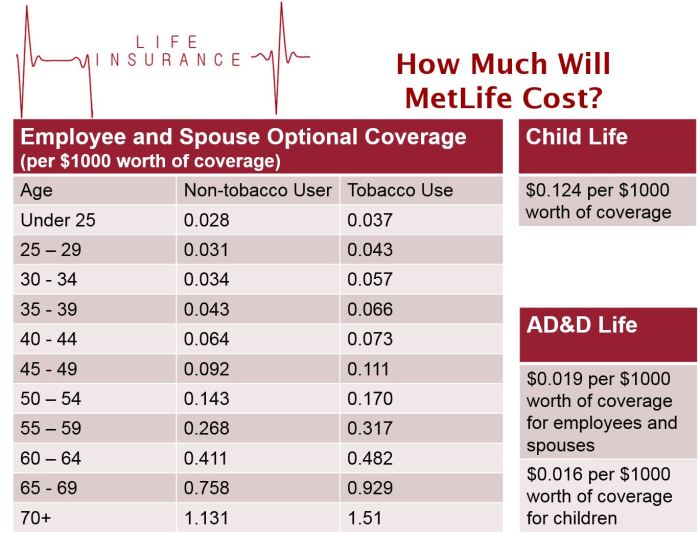

Several factors play a role in determining a life insurance policy’s rating. Age is a big one – the older you are, the higher the risk, and the higher the premium. Health is another major factor. Smokers typically have higher premiums than non-smokers. Lifestyle choices, like risky hobbies or dangerous professions, can also affect your rating.

Think about it like this: if you’re a pro-surfer, you’ll probably pay more for insurance than someone who just walks their dog.

Understanding table ratings for life insurance policies is crucial. A strong table rating often indicates a favorable policy. To get a satisfying lunch, consider checking out the Pomona Park Pizza & Subs menu, here , for delicious options. Ultimately, careful consideration of your financial needs will guide your table rating selection for the most appropriate life insurance coverage.

Significance of Understanding Life Insurance Table Ratings

Knowing how life insurance table ratings work is super important for consumers. It helps you compare different policies and find the best deal. It also lets you avoid getting a policy that’s too expensive or doesn’t provide enough coverage. Imagine buying a phone with a huge contract, only to realize it doesn’t have the features you need.

Similarly, getting the wrong life insurance policy can be a big mistake.

Basic Comparison of Life Insurance Types

| Policy Type | Coverage | Premium | Features |

|---|---|---|---|

| Term Life | Temporary coverage for a set period | Generally lower | Simple, affordable option |

| Whole Life | Lifelong coverage with cash value | Higher | Cash value component, investment growth |

| Variable Life | Lifelong coverage with investment options | Can vary greatly | Investment potential, but also risk of loss |

This table provides a basic overview. Always consult with a financial advisor for personalized recommendations.

Understanding the Components of a Table Rating

Yo, peeps! Life insurance, right? It’s kinda a big deal, especially if you’re tryna secure your future. These ratings tables are like the secret decoder ring to figure out which policies are legit. They break down how strong a company is, so you can make an informed decision. It’s all about finding the best bang for your buck, fam.This ain’t no guessing game.

These ratings aren’t pulled out of thin air. They use specific metrics, and a whole process to figure out how reliable a life insurance company is. Think of it as a report card for insurers. Knowing how they’re scored is key to making a smart choice.

Metrics Used in Creating Life Insurance Table Ratings

Life insurance companies are judged on a bunch of factors. These factors are crucial in assessing their financial health and stability. Factors like solvency, claims-paying ability, and investment strategies are all weighed heavily. The more stable the company, the higher the rating tends to be. A company that consistently pays out claims promptly and fairly is seen as a solid choice.

Methodology Behind Calculating Ratings, Table rating for life insurance

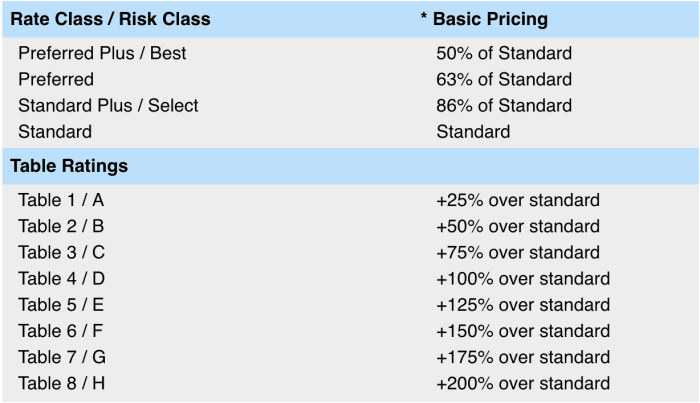

Each rating agency has its own set of rules for calculating these scores. They look at everything from the company’s financial statements to their track record of handling claims. Some agencies might put more emphasis on investment performance, while others focus on the insurer’s history of fulfilling its obligations. Different agencies apply different weights to these various factors, which makes comparing them a bit tricky.

Meaning of Different Rating Scores and Interpretation

These ratings are like grades, but for life insurance companies. A high rating usually means the company is financially sound and trustworthy. They’re likely to pay out claims as promised. A lower rating, however, might suggest some concerns about the company’s stability or ability to meet its obligations. It’s important to look at the specific criteria each agency uses to understand what a particular score means.

It’s like a grade, but with a whole lot more financial implications.

Rating Agencies and Their Methodologies

Different rating agencies have different ways of evaluating life insurance companies. These methods vary, making comparisons a bit tricky. Each agency has its own specific factors and methodologies, making it crucial to understand each agency’s approach. They might weigh factors differently, leading to variations in the final rating.

Comparison of Rating Agencies and Their Criteria

| Rating Agency | Key Criteria | Methodology Overview |

|---|---|---|

| A.M. Best | Financial strength, claims-paying ability, underwriting practices | Evaluates financial strength and stability using detailed financial statement analysis. They pay attention to the insurer’s history of fulfilling its obligations and the company’s capital reserves. |

| Moody’s | Financial stability, solvency, risk management | Uses a more rigorous financial analysis. Looks at the company’s investment strategies and overall risk management practices. They look at the long-term viability of the insurer. |

| Standard & Poor’s | Financial performance, market position, operating efficiency | Examines financial statements, market share, and the insurer’s operational efficiency. Looks at how the insurer is adapting to changing market conditions. |

These are just a few examples, and there are other rating agencies out there. Each agency has its own unique approach to evaluating life insurance companies. Understanding these nuances is crucial to making a smart decision.

Analyzing Different Life Insurance Policies

Yo, peeps! Life insurance, it’s like a safety net, but you gotta know which one’s the right fit for your situation. Different policies have different perks, and knowing the ins and outs is key to getting the best deal. We’re gonna break down the deets on term vs. permanent, how your health and lifestyle affect your rating, and how age and coverage options all play a role.

Term Life Insurance vs. Permanent Life Insurance

Term life insurance is like a short-term commitment. It provides coverage for a specific period (like 10, 20, or 30 years). If you kick the bucket within that timeframe, your beneficiaries get a payout. It’s usually cheaper than permanent policies, but the coverage ends when the term does. Permanent life insurance, on the other hand, is a lifelong commitment.

It builds cash value over time, and you can borrow against it or use it for other stuff. Table ratings often reflect the longer-term risk, and the premiums will typically be higher. Think of it like this: term is a short-term loan, and permanent is a long-term investment. The table ratings usually reflect the difference in risk.

Health Conditions and Lifestyle Choices

Your health and habits can seriously affect your life insurance table rating. Factors like smoking, chronic diseases, and risky activities (like extreme sports) all increase your risk profile, which can translate to higher premiums. Conversely, a healthy lifestyle, including regular check-ups and a nutritious diet, can improve your rating and lower your costs. It’s a smart move to prioritize health if you’re looking to save money.

Insurance companies use this data to calculate risk factors.

Impact of Age on Life Insurance Table Ratings

Age is a huge factor in life insurance. The older you are, the higher your risk of death, so your premiums will usually go up. This is consistent across most policies. Different policies, like term and permanent, react differently to age changes. It’s important to shop around and compare quotes to find the best deal at any age.

Coverage Options and Their Influence on Table Ratings

The amount of coverage you choose directly impacts your premiums. Higher coverage amounts generally mean higher premiums. This is a direct relationship. Think of it like buying more insurance—you’re paying more for the added protection. There are also different riders, or add-ons, that can increase the coverage or add benefits, and these will also influence the premium.

For example, critical illness riders can add more financial protection for certain conditions, but that will affect your table rating.

How Different Coverage Amounts Affect Premiums

| Coverage Amount (Rp) | Estimated Premium (Rp) |

|---|---|

| 100,000,000 | 1,500,000 |

| 200,000,000 | 2,500,000 |

| 300,000,000 | 3,500,000 |

| 500,000,000 | 6,000,000 |

Note: These are estimated premiums and may vary based on individual factors.

Practical Application and Use Cases

Yo, peeps! Life insurance ain’t rocket science, but knowing how to use those table ratings is key to getting the best deal. These ratings are like a cheat sheet, showing you which policies are worth your hard-earned cash and which ones are total scams. So, let’s break it down, fam.Understanding these ratings is crucial for making smart choices.

It’s not just about finding the cheapest policy; it’s about finding one that fits your needs and budget, and these ratings help you do that. Think of it as a GPS for your financial future, guiding you toward the right path.

Using Table Ratings to Make Informed Decisions

These ratings aren’t just pretty numbers. They’re your guide to navigating the complex world of life insurance. Use them to compare different policies, focusing on factors like premiums, coverage amounts, and the overall value proposition. Don’t just pick the first one you see; analyze the details and see if it aligns with your goals.

Interpreting Information in Table Ratings

Table ratings usually break down different factors influencing the cost of a policy. Things like your age, health status, and the type of coverage you choose are all considered. Look for patterns in the data. A younger, healthier person will likely have a lower premium than someone older with pre-existing conditions. This is totally normal, so don’t panic if your numbers look different.

Comparing Different Policies

Comparing policies is like shopping for sneakers. You gotta look at all the features, not just the price tag. Use the ratings to compare premiums, coverage amounts, and any extra perks like accidental death benefits or critical illness riders. Remember, a lower premium might not be the best deal if the coverage isn’t enough or the policy has hidden fees.

Real-World Scenarios

Imagine you’re a student in Surabaya, saving for your future. Using table ratings helped you find a policy with a low premium that still offered enough coverage for your goals. Or, maybe you’re a young professional with a family. Table ratings helped you find a policy that fit your needs and budget. These are just examples; the possibilities are endless.

The key is to be informed.

Premium Comparison Based on Age and Health

| Age | Healthy (No Pre-existing Conditions) | Moderate Health (Minor Pre-existing Condition) | Less Healthy (Significant Pre-existing Condition) |

|---|---|---|---|

| 20 | Rp 1,000,000 | Rp 1,200,000 | Rp 1,500,000 |

| 30 | Rp 1,500,000 | Rp 1,800,000 | Rp 2,200,000 |

| 40 | Rp 2,000,000 | Rp 2,500,000 | Rp 3,000,000 |

Note: This table is a hypothetical example and premiums can vary greatly based on specific policy features, provider, and other factors. Always consult with a financial advisor to get personalized recommendations.

Factors Influencing Table Ratings

Yo, peeps! Life insurance ain’t just about the policy, it’s about your whole vibe. Your health and lifestyle choices directly affect how much you pay for that sweet, sweet coverage. It’s all about being real with the insurance company. So, let’s dive into the nitty-gritty.Insurance companies, they gotta figure out your risk level. That’s where health and lifestyle come in.

They look at stuff like your medical history, how you live your life, and even what you eat. The healthier you are, the lower your premiums usually are. It’s a win-win, right?

Impact of Health Conditions

Health conditions, whether you’re aware of them or not, play a massive role in determining your life insurance premiums. Things like high blood pressure, diabetes, or even asthma can bump up your rate. The severity and chronicity of the condition are key factors in how much it impacts your policy. Imagine, if you’ve got a pre-existing condition, it’s important to be upfront about it with the insurer.

Hiding stuff could mean higher premiums or even denial of coverage.

Influence of Lifestyle Choices

Your lifestyle choices are equally important. Think about it—a super active person vs. someone who sits all day. The active person likely has a lower risk of heart disease, and that translates to a lower premium. It’s not just about working out; it’s about making smart choices every day.

Smoking, eating junk food, and avoiding exercise are huge red flags. These choices significantly impact your health and, consequently, your insurance rate.

Impact of Smoking, Diet, and Exercise

Smoking is a major no-no for insurance companies. It’s a huge risk factor for various health issues. This directly affects your life insurance table rating, as smoking drastically increases your risk of death and illness. A poor diet can also seriously impact your rate. Your diet plays a crucial role in your overall health, and insurance companies consider this.

Exercise, on the other hand, is your secret weapon against high premiums. Regular exercise significantly reduces your risk, and insurers recognize this. It’s a smart move for a healthier lifestyle and lower insurance costs.

Implications of Pre-Existing Conditions

Pre-existing conditions, like past illnesses or injuries, are a key factor in determining your life insurance table rating. If you’ve had a serious illness in the past, the insurance company will want to know about it. They’ll need to assess the severity and duration of the condition to determine its impact on your long-term health. Honest disclosure is key here.

Understanding your life insurance table rating is crucial for financial planning. Consider the cost-effectiveness of life insurance policies, and if you’re looking to purchase a new home, such as those available in New Canaan, CT, houses in new canaan ct are increasingly in demand, impacting the overall insurance market. This means carefully reviewing the table rating will help you select the most suitable life insurance policy for your needs and budget.

It can affect the premium you pay or even lead to the policy being denied. However, there are sometimes ways to mitigate these risks, such as through treatment plans or other health management strategies.

Table Showing Effects of Health Factors on Premiums

| Health Factor | Impact on Premium | Example |

|---|---|---|

| High Blood Pressure | Higher Premium | A person with uncontrolled high blood pressure will pay more than someone with normal blood pressure. |

| Diabetes | Higher Premium | Someone diagnosed with type 2 diabetes will likely pay more than someone without the condition. |

| Smoking | Significantly Higher Premium | A smoker will pay substantially more than a non-smoker. |

| Regular Exercise | Lower Premium | Someone who regularly exercises and maintains a healthy lifestyle will likely pay less. |

| Healthy Diet | Lower Premium | A person who follows a healthy diet will likely pay less. |

Comparing Different Life Insurance Providers

Yo, peeps! Life insurance, it’s like choosing a squad for your future. You gotta pick a provider that’s reliable, legit, and won’t bail on you when you need ’em most. So, let’s break down how to compare different insurance companies.Different companies have different strengths and weaknesses, just like different crews. Some are known for their super low premiums, others for their top-notch customer service.

Knowing the ins and outs of each provider helps you make an informed decision.

Provider Reputation and Financial Stability

Insurance companies, like any business, have a reputation. A strong reputation means they’ve got a good track record, paying claims on time and treating customers fairly. Look for companies with a history of financial stability. A company with a strong financial foundation is less likely to go belly up, leaving you high and dry when you need your policy.

A solid financial standing is key for long-term peace of mind.

Factors Influencing Provider Ratings

Plenty of factors influence a company’s rating, from the quality of their customer service to their claims handling. Their financial health, solvency, and ability to pay claims are crucial. Claim payout history is a big deal; companies that consistently pay out on time and fairly will generally get higher ratings. A company that has a history of paying claims quickly and accurately demonstrates financial responsibility and customer care.

Comparative Analysis of Provider Ratings

Here’s a table showcasing the ratings of different life insurance providers in Indonesia. This table is for illustrative purposes only and does not constitute financial advice. Always consult with a financial advisor for personalized recommendations.

| Provider | Table Rating (Out of 10) | Financial Strength Rating | Customer Service Rating | Claim Payout History |

|---|---|---|---|---|

| Company A | 8.5 | Excellent | Good | Excellent |

| Company B | 7.8 | Good | Average | Good |

| Company C | 9.2 | Excellent | Excellent | Excellent |

| Company D | 6.5 | Fair | Poor | Fair |

This table provides a basic comparison. Remember, ratings can change, and other factors, like policy specifics, should also be considered.

Reliability and Trustworthiness

Picking a reliable and trustworthy insurance provider is key. Look for companies with a history of meeting their obligations, and don’t hesitate to check online reviews and testimonials from existing customers. Look for testimonials and reviews from other customers. Word-of-mouth recommendations from satisfied customers can give you valuable insight. This will help you to get a better idea of the company’s trustworthiness.

A provider’s reputation for reliability and trustworthiness directly impacts the policyholder’s confidence in the insurance company.

Tips for Consumers Evaluating Life Insurance Options: Table Rating For Life Insurance

Yo, peeps! Life insurance ain’t no joke. It’s a serious decision, and you gotta be clued up before you sign on the dotted line. This ain’t some TikTok trend; this is about your future and your fam. So, let’s dive into some real tips to help you navigate this whole process.This guide breaks down how to evaluate life insurance options like a pro.

We’ll cover comparing policies, seeking expert advice, and making smart choices that fit your needs. Forget the hype; we’re here to give you the lowdown on how to actually get the best deal.

Comparing Table Ratings Across Providers

Different life insurance companies use different rating systems. Understanding these systems is key to comparing apples to apples. Look for consistency in the ratings across different providers, and don’t just focus on one company’s numbers. Analyze the methodology behind the ratings, and see if it aligns with your personal needs. For example, a company that emphasizes coverage for specific health conditions might have a different rating system than one that prioritizes general mortality rates.

Importance of Seeking Professional Advice

Don’t be a hero when it comes to life insurance. Talking to a financial advisor is like having a secret weapon in your corner. They can help you navigate the complexities of different policies and find the best fit for your budget and goals. They can explain the fine print in a way that’s easy to understand, and they can offer unbiased advice.

Role of Independent Financial Advisors

Independent financial advisors are your allies in this process. They’re not tied to any particular insurance company, so they can give you objective recommendations based on your unique situation. They’ll help you understand the pros and cons of different policies and ensure you’re making an informed decision. They can also help you assess your current financial situation and create a plan that aligns with your goals.

Think of them as your personal financial navigator.

Tips to Evaluate Insurance Policies

- Thoroughly review policy documents: Don’t just skim the fine print; read every word. Pay attention to the exclusions, limitations, and coverage details. Understanding the terms and conditions is crucial to avoid unpleasant surprises later.

- Compare coverage amounts and benefits: Consider your family’s needs and future financial goals. Calculate how much coverage you need and compare policies based on their payout amounts and additional benefits.

- Assess policy fees and premiums: Understand the costs associated with the policy. Compare premiums across different providers and consider whether the benefits justify the cost. Compare the long-term cost to your overall budget.

- Understand the policy’s cash value options (if applicable): Some policies offer cash value accumulation. Research how these options work and if they align with your financial objectives.

- Consider your existing insurance and financial plans: How does this policy fit with your current life insurance, retirement plan, and other investments? Ensure that the policy doesn’t conflict with existing plans.

Visual Representation of Data

Yo, peeps! Life insurance ain’t rocket science, but understanding the numbers can be kinda tricky. Visuals make it way easier to grasp the different factors that affect your premiums. Think of it like a cheat sheet for navigating the whole life insurance jungle.Visuals help us quickly spot trends and patterns, which is crucial when making smart choices about your policy.

This section breaks down how to use visual representations to understand age, policy type, health, coverage, and lifestyle impacts on your life insurance costs.

Age and Premiums

Visualizing the relationship between age and premiums helps you see how costs increase with time. A simple line graph would work, with age on the x-axis and premiums on the y-axis. You’d see a clear upward trend, meaning premiums generally go up as you get older. This is because the risk of death increases with age, which insurance companies factor into their pricing.

For example, a 20-year-old might pay a fraction of what a 50-year-old pays for the same coverage.

Policy Types and Premiums

Different policy types have different price tags. A bar graph, with policy types on the x-axis and premiums on the y-axis, would illustrate this. Term life insurance, for example, usually has lower premiums than whole life, but it’s only good for a set period. Permanent policies like whole life, on the other hand, offer lifelong coverage but come with higher premiums.

Health Conditions and Life Insurance Ratings

Visual representations can show how health conditions affect life insurance ratings. A segmented bar graph, for instance, could display the average premiums for different health categories. A category like “no known health conditions” would likely show a lower premium compared to “pre-existing conditions,” highlighting the impact of health on your costs. For example, a person with a history of heart disease might pay substantially more for coverage than someone with no such history.

Coverage Amounts and Policy Costs

Visualizing coverage amounts for different policies is easy. A scatter plot showing coverage amounts on the x-axis and premiums on the y-axis would be effective. A larger coverage amount would generally correlate with a higher premium. This visual representation helps you understand the trade-offs between coverage and cost.

Lifestyle Choices and Life Insurance Costs

Visualizing the impact of lifestyle choices on life insurance costs can be done through a series of stacked bar charts. One bar could represent the baseline premium for a ‘healthy’ lifestyle, while others could show increases for factors like smoking, excessive drinking, or lack of exercise. For example, a smoker could pay a significant premium increase compared to a non-smoker with similar health conditions.

Conclusive Thoughts

In conclusion, understanding life insurance table ratings is vital for making informed decisions about your coverage. By examining the factors that influence these ratings, you can effectively compare policies and choose the best fit for your needs. This guide provides a comprehensive overview, empowering you with the knowledge to navigate the complexities of life insurance and select a policy that aligns with your financial goals and personal circumstances.

Remember to seek professional advice when necessary.

Expert Answers

What factors influence the table ratings for life insurance policies?

Age, health conditions, lifestyle choices, and the type of policy are key factors in determining the table rating. Different providers use varying methodologies, so it’s essential to compare policies from multiple sources.

How can I compare life insurance policies based on their table ratings?

Compare the ratings for various policies across different providers, paying close attention to the factors that affect the ratings, such as age and health. Use the provided tables to aid in this process.

What are the different types of life insurance policies?

Common types include term life insurance, which provides coverage for a specific period, and permanent life insurance, which offers lifelong coverage. The table ratings reflect the varying risks and benefits associated with each type.

How do I interpret the different rating scores for life insurance?

Rating scores indicate the risk level associated with an applicant. Lower scores generally suggest a lower risk, leading to potentially lower premiums. Always consult with an insurance professional to interpret these scores within the context of your specific circumstances.