What is pro rata in insurance? This intricate aspect of policy calculations and claims adjustments unlocks a deeper understanding of the principles governing insurance contracts. It’s a profound exploration of equitable distribution, ensuring fairness and transparency in coverage and payouts.

Pro rata calculations, in essence, determine the proportionate share of insurance coverage or premiums based on the actual time period a policy was active. Understanding this fundamental principle is key to navigating the complexities of insurance claims and premiums, allowing for a harmonious relationship between policyholders and insurers. This exploration delves into the specifics of pro rata calculations in various insurance types, from health to auto, and considers the nuances of policy renewals, cancellations, and deductibles.

Defining Pro Rata in Insurance

Pro rata, in the insurance world, means “in proportion.” It’s a crucial concept for calculating insurance coverage when a policy period is shortened or extended. It ensures fair compensation based on the actual time the policy was active.Pro rata calculations in insurance are fundamental for determining premiums, claims payouts, and coverage adjustments. They are based on the principle of equitable distribution of benefits and costs, taking into account the portion of the policy term that was utilized.

Pro Rata Definition in Insurance

Pro rata in insurance means calculating amounts based on a proportional share of the policy period. This is vital for various scenarios where the policy’s duration changes or the insured event occurs within a specific time frame. The core idea is to allocate expenses or benefits in proportion to the time covered.

Situations Requiring Pro Rata Calculations

Pro rata calculations are frequently used in several insurance situations. These include:

- Policy Cancellations: If a policyholder cancels their policy before its expiration date, the premium is usually adjusted pro rata to reflect the unused portion of the policy period. This prevents the policyholder from receiving unearned benefits or the insurer from paying for coverage that was never used.

- Policy Extensions: Conversely, when a policy is extended, the premium calculation is adjusted pro rata to account for the additional coverage period.

- Partial Coverage Periods: If a policy covers a specific event or damage, but the damage occurred only for a portion of the policy term, the claim payout is calculated pro rata.

- Short-Term Policies: Policies designed for specific events, such as trip insurance, often utilize pro rata calculations to determine coverage for partial periods, for instance, when a trip is cut short.

Examples of Pro Rata Calculations in Insurance Claims

Imagine a homeowner’s insurance policy with a $100,000 annual premium. The policy covers a 12-month period. If the policyholder cancels the policy after 9 months, the pro rata calculation would be: (9 months / 12 months)$100,000 = $75,000. The refund due to the policyholder would be $75,000.Another example: A car insurance policy covers a 6-month period. If a claim for a fender bender is filed after 3 months, the payout would be determined by the pro rata calculation.

The calculation would be: (3 months / 6 months)$2,000 (claim amount) = $1,000. In this case, the insurance company would only pay $1,000 for the damage.

Pro Rata Calculation Methods in Different Policy Types

| Policy Type | Triggering Event | Pro Rata Calculation Method |

|---|---|---|

| Homeowner’s Insurance | Damage from a storm | Proportion of the policy term when the storm occurred divided by the total policy period. |

| Auto Insurance | Accident during a specific time period | Proportion of the policy term when the accident occurred. |

| Health Insurance | Medical expenses incurred during a specific time frame | Proportion of the policy term when the medical expenses were incurred. |

| Travel Insurance | Trip cancellation due to unforeseen circumstances | Proportion of the trip duration remaining. |

Calculating Pro Rata Premiums: What Is Pro Rata In Insurance

Pro rata premiums are a crucial part of insurance calculations when a policy’s term is adjusted. Understanding how to calculate them ensures fair compensation for the portion of coverage provided. This section delves into the steps, examples, and factors influencing pro rata premium calculations.Calculating pro rata premiums is a straightforward process, involving a proportional division of the total premium based on the policy’s duration.

This ensures that the insurer receives the appropriate amount for the coverage provided and the policyholder is not overcharged or undercharged.

Steps in Calculating Pro Rata Premiums

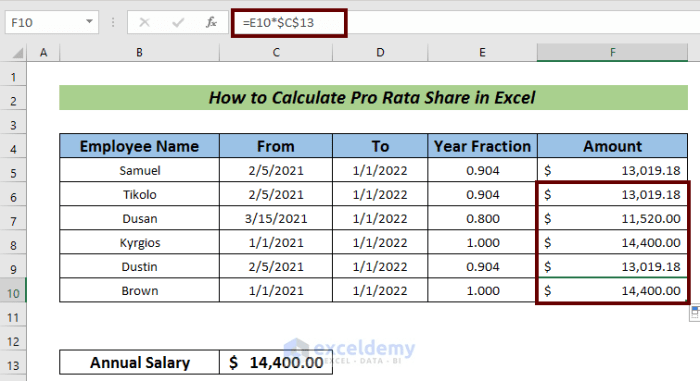

Determining the pro rata premium involves a few key steps. First, identify the policy’s start and end dates. Second, calculate the duration of the policy in days. Third, establish the total premium amount for the policy. Fourth, determine the portion of the policy term for which coverage was provided.

Finally, calculate the pro rata premium by multiplying the total premium by the fraction representing the portion of the policy term.

Pro rata in insurance, a whisper in the wind, simply means a proportional share. A strange, ticklish sensation, isn’t it? It’s like the echoes of a forgotten agreement, whispering of fair compensation. This concept, this delicate dance of proportion, finds its curious reflection in the grand, imposing structure of the Bank of the Ozarks Arena in Hot Springs , where the very foundations seem to hum with a similar, calculated fairness.

But what is the true meaning of this proportional distribution, this pro rata enigma? The answer, like a phantom limb, flickers and fades, leaving only the whisper of a hidden truth.

Policy Duration and Pro Rata Calculations, What is pro rata in insurance

Policy duration is a critical factor in calculating pro rata premiums. The calculation hinges on the difference between the policy’s intended duration and the actual duration of coverage. For instance, a policy intended for a year but canceled after six months will have a pro rata premium calculation based on six months of coverage.

Impact of Policy Start and End Dates

The policy’s start and end dates directly influence the pro rata calculation. A policy beginning on June 1st and ending on September 30th will have a different pro rata calculation than a policy beginning on October 1st and ending on December 31st. The exact number of days covered determines the proportion of the total premium.

Policy Cancellations and Pro Rata Premiums

Policy cancellations often trigger pro rata premium calculations. If a policy is canceled before its intended end date, the insurer returns a portion of the premium based on the unused coverage period. This ensures fairness to the policyholder.

Methods for Calculating Pro Rata Premiums

The core method for calculating pro rata premiums is the proportional method. This involves dividing the total premium by the number of days in the policy term, then multiplying this daily rate by the number of days the policy was active. This straightforward method ensures accuracy in calculating pro rata premiums.

Example Pro Rata Premium Calculations

| Policy Start Date | Policy End Date | Policy Term (Days) | Total Premium | Coverage Days | Pro Rata Premium |

|---|---|---|---|---|---|

| 2024-01-15 | 2024-06-15 | 152 | 1200 | 120 | 960 |

| 2024-03-01 | 2024-09-30 | 200 | 1500 | 180 | 1350 |

| 2024-07-01 | 2024-12-31 | 183 | 1800 | 150 | 1200 |

This table illustrates pro rata premium calculations for various policy scenarios. The calculations consider the total premium, coverage days, and the total policy term. The resulting pro rata premiums reflect the proportional amount for the actual coverage period.

Pro Rata and Insurance Claims

Pro rata adjustments are common in insurance claims when coverage doesn’t span the entire policy period. This ensures fairness by only charging or paying for the portion of the policy that was actually in effect. Understanding how pro rata works is crucial for both policyholders and insurers to accurately assess claim settlements.

Pro Rata Application to Partial Coverage Periods

Pro rata adjustments in insurance claims directly relate to the length of time the policy was active. If a claim arises during a period where coverage was only partially in effect, the settlement amount is proportionally reduced to reflect the time the policy was active. This is essential for accurately determining the amount of coverage applicable to the specific period of the claim.

Pro Rata in Early Termination Cases

When an insurance policy is terminated early, either by the policyholder or the insurer, pro rata adjustments are made to reflect the portion of the premium paid for the unused portion of the policy. This ensures that neither party is overcharged or underpaid.

Examples of Pro Rata Adjustments to Claim Amounts

Imagine a homeowner’s insurance policy with a $1,000 annual premium. The policyholder cancels their policy after 6 months. A claim for damage arises after 4 months. The premium paid for the policy is $500 (6 months out of 12). If the claim was for $2,000, the pro rata adjustment would reduce the payout to $1,000 ( ($500 / $1,000) – $2,000 ).

Conditions for Pro Rata Adjustments

Pro rata adjustments are generally applied when the insurance policy is cancelled or expires before the entire policy period. They are also relevant if the claim occurs during a partial policy period. A clear understanding of the policy’s terms and the date of claim is essential to apply the pro rata calculation accurately.

Method for Calculating Pro Rata Claim Amounts

The method for calculating pro rata claim amounts involves determining the proportion of the policy period during which coverage was active. This proportion is then applied to the total claim amount.

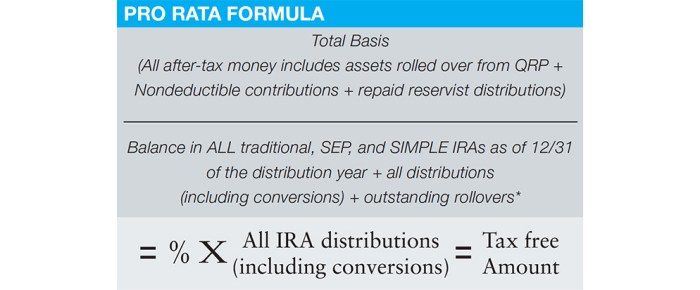

Formula: (Days of coverage / Total days in policy period)

Total claim amount

This formula is used to calculate the pro rata amount owed.

Table Illustrating Scenarios where Pro Rata is Applied to Claims

| Scenario | Policy Period | Claim Date | Coverage Days | Total Claim Amount | Pro Rata Claim Amount |

|---|---|---|---|---|---|

| Policy cancelled after 6 months | 12 months | 4 months | 4 months | $5,000 | $2,000 |

| Policy in effect for 9 months | 12 months | 7 months | 7 months | $2,500 | $1,458.33 |

| Policy in effect for 3 months | 12 months | 1 month | 1 month | $1,000 | $250 |

Pro Rata in Different Insurance Types

Pro rata, meaning “in proportion,” is a crucial concept in insurance, determining how premiums or benefits are adjusted when a policy’s coverage period isn’t the full term. Understanding how pro rata applies across various insurance types helps policyholders grasp the financial implications of partial coverage periods.Applying pro rata principles ensures fairness by distributing premiums or claims based on the actual time the policy was in effect.

This avoids overcharging or undercompensating during periods of partial coverage.

Health Insurance Pro Rata

Health insurance policies often utilize pro rata calculations for premiums when a policyholder joins or leaves a plan mid-term. The premium adjustment depends on the exact date of enrollment or termination and the length of the policy period. For example, if a policyholder joins a plan halfway through the billing cycle, they will only be charged for the remaining portion of the period.

Conversely, if a policyholder leaves a plan before the end of the billing cycle, they will receive a pro rata refund for the unused portion of the premium.

Auto Insurance Pro Rata

Auto insurance policies may use pro rata calculations for premiums if a policyholder moves or sells a car. This ensures a fair premium for the remaining coverage period. A policyholder who sells their car before the end of the policy term might receive a pro rata refund for the unused portion of the coverage. Similarly, if someone purchases a car mid-term and takes over the existing policy, they might be required to pay a pro rata premium.

Property Insurance Pro Rata

Property insurance policies might adjust premiums pro rata when coverage is extended or reduced. For example, if someone extends their property insurance coverage to include an additional building, they might be charged a pro rata premium for the additional coverage period. Conversely, if they reduce their coverage, a pro rata adjustment might occur to reflect the reduced coverage.

Pro Rata Calculation Variations Based on Policy Conditions

Different policy conditions can influence the pro rata calculation. Policy terms, such as cancellation clauses, endorsements, and add-ons, can affect how the pro rata calculation is performed. For instance, certain policies may have clauses specifying a minimum payment period, regardless of the policyholder’s departure.

Uniform Pro Rata Calculation Across Insurance Types?

While the fundamental principle of pro rata (proportional calculation) is consistent across various insurance types, the specific calculation methods and formulas can differ based on the insurance type and the particular policy terms. The detailed calculation can vary considerably depending on factors like policy terms and specific provisions.

Table of Pro Rata Calculation Approaches in Different Insurance Types

| Insurance Type | Pro Rata Calculation Approach |

|---|---|

| Health Insurance | Premiums adjusted based on enrollment/termination dates within the billing cycle. |

| Auto Insurance | Premiums adjusted based on changes in vehicle ownership or coverage modifications during the policy term. |

| Property Insurance | Premiums adjusted based on additions, deletions, or changes to the property or coverage duration. |

Pro Rata and Policy Deductibles

Pro rata calculations in insurance policies often affect the amount of your deductible. Understanding how these calculations work is crucial for knowing the actual cost you’ll bear in case of a claim. It’s not always a simple 1:1 relationship; the pro rata aspect can influence how much you pay upfront.Pro rata adjustments to deductibles directly relate to the portion of the policy period you’ve been insured for.

If you cancel your policy early, your deductible might be reduced. Conversely, if you add insurance coverage during a period, your deductible could be proportionally adjusted.

How Deductibles are Affected by Pro Rata Calculations

Pro rata calculations for deductibles are based on the proportion of the policy period you’ve been covered. If you cancel or modify your policy before the policy’s end date, the deductible amount might be lowered in proportion to the unused portion of the policy period.

Examples of Pro Rata Calculations Involving Policy Deductibles

Let’s say you had a homeowners insurance policy with a $1,000 deductible. You purchased the policy on January 1st and canceled it on April 30th. The policy covers a 12-month period. You’ve used 3/12 (or 1/4) of the policy period. Your pro rata deductible would be $250 (1/4 of $1,000).Another example: You add an extension to your auto insurance policy.

You initially had a $500 deductible, and the policy was for 6 months. If you extended the policy by 2 months, the deductible would likely stay the same, since the coverage period isn’t reduced.

Situations Where Deductibles Are Not Subject to Pro Rata Adjustments

Deductibles are not always subject to pro rata adjustments. For instance, if you’re dealing with a claim that exceeds the policy’s coverage, the deductible won’t be affected by pro rata calculations. Also, if you are covered by a policy and a claim happens during that coverage period, the pro rata principle doesn’t impact the deductible for that claim.

Method for Calculating Pro Rata Adjustments to Policy Deductibles

To calculate a pro rata adjustment to a policy deductible, divide the number of days you were insured by the total number of days in the policy period. Then, multiply this fraction by the original deductible amount.

Formula: (Days Insured / Total Policy Days)

Original Deductible = Pro Rata Deductible

Table of Policy Scenarios and Pro Rata Deductible Adjustments

| Policy Scenario | Days Insured | Total Policy Days | Pro Rata Fraction | Original Deductible | Pro Rata Deductible |

|---|---|---|---|---|---|

| Policy started January 1, canceled April 15 | 115 | 365 | 0.315 | $500 | $157.50 |

| Policy started March 1, canceled May 31 | 92 | 365 | 0.25 | $1000 | $250 |

| Policy started June 1, claim happened September 15 | 105 | 365 | 0.288 | $2000 | $576 |

Illustrative Cases of Pro Rata Application

Pro rata, meaning “in proportion,” is a crucial concept in insurance. It ensures fair compensation or premium adjustments when policy terms are altered or events change the duration of coverage. Understanding pro rata calculations is vital for both policyholders and insurers.Pro rata adjustments reflect the portion of coverage or premium that corresponds to the actual time the policy was in effect.

This prevents overcharging for partial coverage or undercompensating for services rendered. These adjustments are common in situations where policies are canceled, renewed, or coverage periods are shortened due to specific events.

Homeowners Insurance Policy Cancellation

A homeowners insurance policy was purchased on January 15th, with a yearly premium of $1,200. The policyholder decided to cancel the policy on April 15th. The calculation for the pro rata premium refund is based on the portion of the policy year covered.From January 15th to April 15th, there are 90 days. A full year has 365 days (or 366 in a leap year).

The ratio of days covered to the total days in the year is 90/365. This ratio is applied to the total premium to determine the refund.

Pro Rata Refund = (90/365) – $1,200 = $295.89

The insurer will refund $295.89 to the policyholder. The reasoning behind this adjustment is to fairly compensate the policyholder for the unused portion of the insurance coverage.

Auto Insurance Policy Renewal

A driver renewed their auto insurance policy on June 1st. The original policy was set to expire on August 31st. The new policy, with a yearly premium of $1,800, covered the remaining period until the end of the original coverage term.The original policy covered from June 1st to August 31st, encompassing 92 days. Using the same calculation as above, the pro rata premium for the new policy is:

Pro Rata Premium = (92/365) – $1,800 = $461.64

The new policy will be charged $461.64 for the period from June 1st to August 31st. This ensures the insurer is compensated for the portion of coverage provided and the driver is not overcharged.

Illustrative Cases Table

| Case | Policy Type | Policy Details | Event | Pro Rata Calculation | Reasoning |

|---|---|---|---|---|---|

| 1 | Homeowners | Yearly premium: $1,500, effective: March 1st | Policy canceled on June 30th | (120/365) – $1,500 = $493.15 | Policyholder receives a partial refund for the unused portion of the coverage. |

| 2 | Auto | Yearly premium: $2,000, effective: July 15th | Policy renewed on November 15th to cover the remainder of the year. | (162/365) – $2,000 = $890.41 | Insurer is compensated for the portion of coverage provided, and the driver is not overcharged. |

| 3 | Health | Monthly premium: $500, effective: January 1st | Policyholder moves to another state and coverage terminates on April 30th. | (4 months/12 months)

|

Policyholder pays for the portion of coverage they utilized. |

Pro Rata and Policy Renewals

Pro rata calculations aren’t just for new policies; they also play a crucial role in adjusting premiums when you renew an existing one. Understanding how pro rata applies to renewals is key to knowing how much you’ll pay. Renewal situations often involve changes in coverage, which directly impact the pro rata adjustments.Renewal policies often necessitate pro rata calculations to reflect any changes in the insured risk or coverage terms.

This ensures fairness and accuracy in premium adjustments, accounting for the duration of the new policy period and the remaining portion of the original policy term.

Pro Rata Application to Policy Renewals

Renewal policies, much like new policies, often involve a pro rata adjustment to account for the period of coverage. This adjustment ensures a fair premium calculation when the original policy term overlaps with the new policy period. Changes in coverage, whether increases or decreases, are a key aspect in these calculations. The portion of the original policy term that is covered by the renewal policy is considered.

A new policy period will typically involve a new premium rate. The pro rata calculation takes into account the portion of the new policy period and the remaining portion of the original policy term.

Effect of Policy Renewal on Pro Rata Calculations

Renewal policies, unlike new policies, frequently use the remaining portion of the existing policy period to determine the pro rata premium adjustment. This is critical because it ensures fairness and reflects the portion of the original policy period being covered by the renewal. The calculations also consider any changes in the coverage, such as increased or decreased coverage, during the renewal process.

Adjustments are made based on the changes in the coverage and the duration of the renewed period.

Pro Rata Calculation for Renewals with Coverage Changes

When renewing a policy with changes in coverage, the pro rata calculation becomes more complex. The existing coverage is compared to the renewed coverage. This comparison dictates the adjustment in the premium. The calculation takes into account the period of the original policy and the period of the renewed policy, alongside the changes in coverage. This means the amount of the adjustment can be larger or smaller depending on the coverage changes and the period of the renewed policy.

Pro rata in insurance, a subtle whisper of fairness, adjusts payouts based on the duration of coverage. A chilling curiosity about blood bank jobs in new york blood bank jobs in new york might, in some twisted way, mirror this calculated compensation. A phantom touch, a fleeting glance, a pro rata adjustment—the fine print of fate, perhaps?

The intricate dance of insurance payouts, nonetheless, continues.

Factors Affecting Pro Rata Adjustments During Renewal

Several factors influence pro rata adjustments during policy renewals. These include:

- Changes in coverage: Increases or decreases in coverage directly impact the premium. Higher coverage usually leads to higher premiums, while reduced coverage can result in lower premiums.

- Changes in premium rates: If the premium rates have changed since the initial policy, the pro rata calculation reflects these changes.

- Duration of the renewal period: The length of time covered by the renewal policy influences the pro rata calculation.

- Remaining portion of the original policy term: The portion of the original policy that overlaps with the renewal period is crucial in determining the pro rata adjustment.

Examples of Pro Rata Calculations for Policy Renewals

Let’s illustrate with a few examples. Assume a homeowner’s insurance policy with a premium of $1,200 for a year.

- Example 1: The policy is renewed for six months with no changes in coverage. The pro rata premium is $600 (1/2

– $1,200). - Example 2: The policy is renewed for a full year, but the coverage is increased by 20%. The new premium, calculated using the original rate and adjusted for the increased coverage, is $1,440. The pro rata premium is then determined based on the period of the renewal and the new premium.

Table Comparing Pro Rata Calculations for Renewal Policies

This table summarizes pro rata calculations for renewal policies under different conditions.

| Scenario | Original Premium | Renewal Period | Coverage Change | Pro Rata Premium |

|---|---|---|---|---|

| Renewal for 6 months, no changes | $1,500 | 6 months | None | $750 |

| Renewal for 12 months, 10% increase | $2,000 | 12 months | 10% increase | $2,200 |

| Renewal for 9 months, 20% decrease | $3,000 | 9 months | 20% decrease | $2,100 |

Last Word

In conclusion, pro rata in insurance is a cornerstone of fair and equitable distribution within the intricate tapestry of insurance contracts. It ensures that policyholders and insurers alike are treated justly, regardless of policy duration or claim circumstances. By understanding the principles and methodologies of pro rata calculations, one gains a profound appreciation for the meticulous nature of insurance practices.

This allows for greater clarity, transparency, and trust in the insurance industry, fostering a sense of shared responsibility and mutual understanding.

FAQ Insights

What happens if my insurance policy is canceled early?

If your policy is canceled before its intended end date, a pro rata adjustment will be applied to the premium. This means you’ll receive a refund for the unused portion of your policy coverage.

How does pro rata affect claim settlements?

If a claim arises during a partial policy period, the claim settlement amount will be adjusted proportionally to reflect the period of coverage. This ensures that the compensation aligns with the duration of active insurance.

Does pro rata apply to all types of insurance?

Yes, pro rata calculations are applicable to various insurance types, including health, auto, and property. However, specific calculation methods may vary depending on the policy conditions and insurer’s terms.

What are the key factors that influence pro rata calculations?

The key factors that influence pro rata calculations are the policy start and end dates, the duration of coverage, and any relevant policy conditions that may be in place. This ensures fairness in calculating premiums and claims based on actual coverage time.